Apartments.com Rent Report for February 2026: Boston-Area Student Enrollment Drives Rent Drops

Key Takeaways

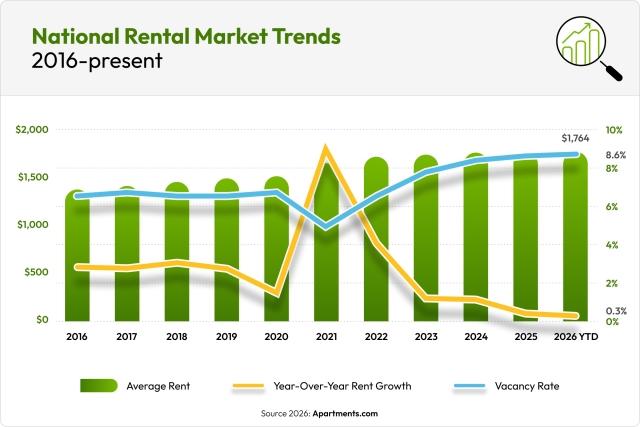

- The national average rent was $1,626 per month, an increase of 0.4% over the last year.

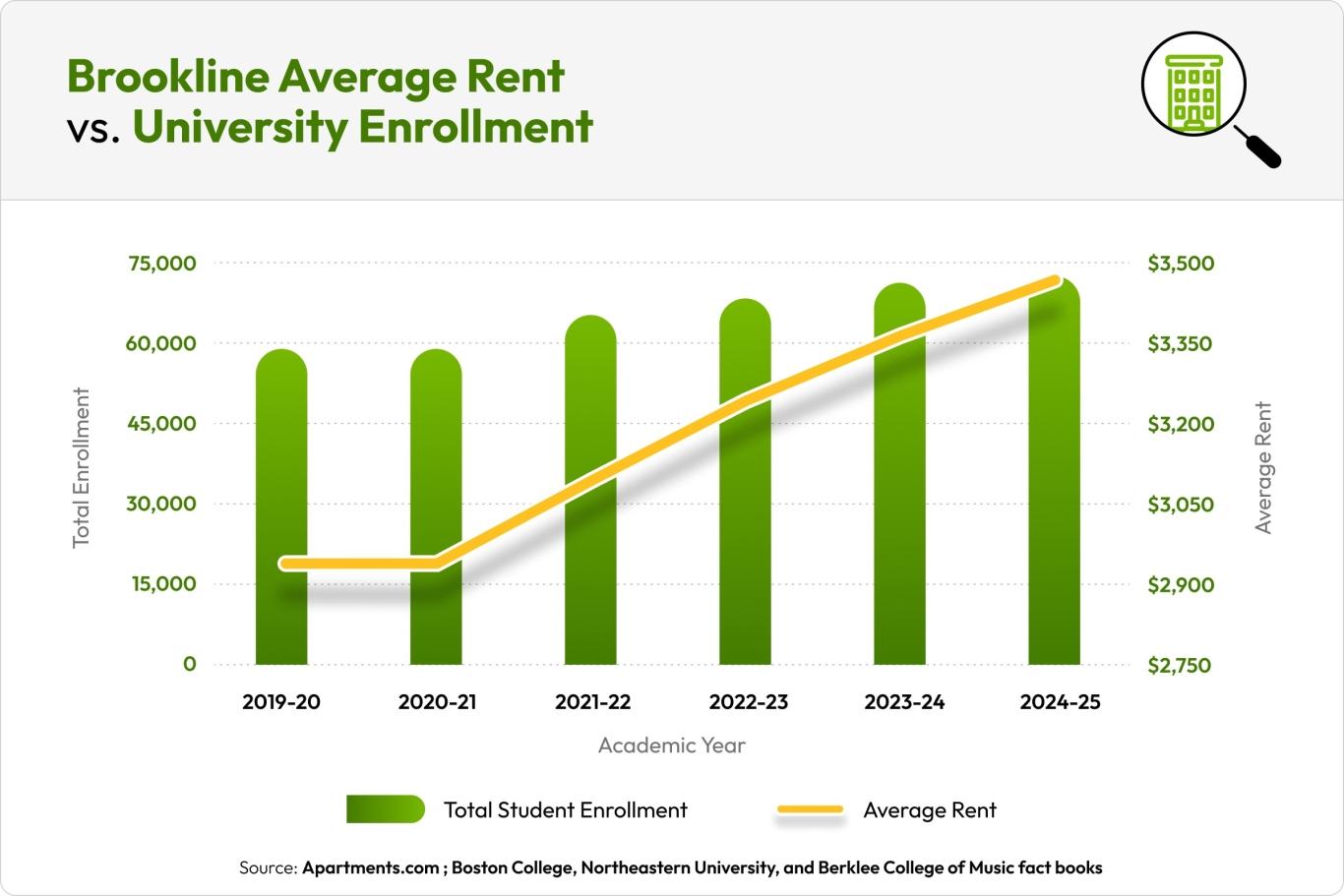

- Rent in Brookline, MA, has started to decrease as enrollment in nearby universities stabilizes and inventory catches up to demand.

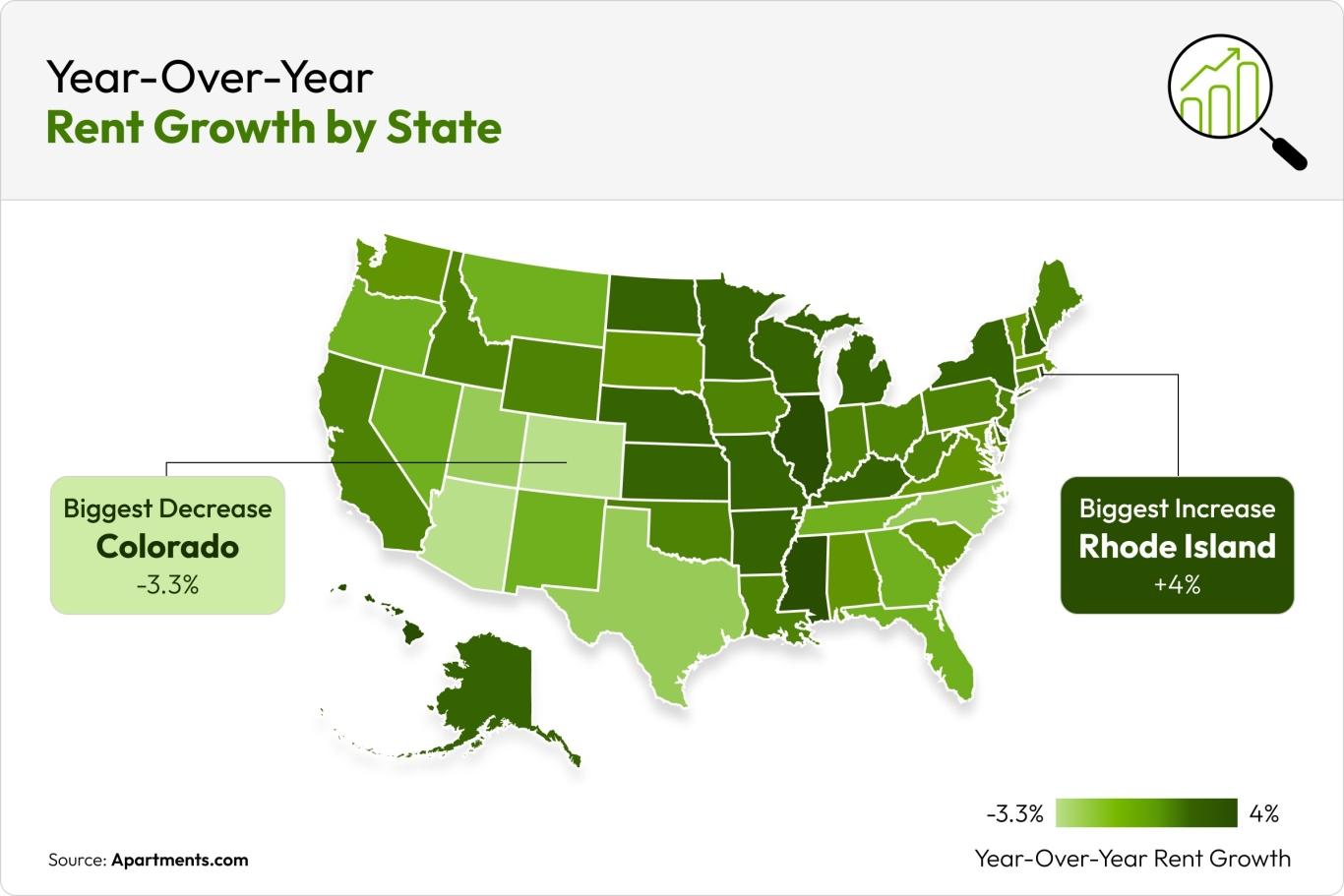

- Rhode Island’s year-over-year rent increase is up to 4%, with the average one-bedroom rent at $1,828 per month.

In February, the national average rent was $1,626 per month for a one-bedroom and $1,882 per month for a two-bedroom. This was an increase of 0.4% from February 2025. The national vacancy rate remains at 8.6%, up three percentage points from a year ago.

Boston-Area University Enrollment Plateaus

Rent growth in Brookline, MA, is in the negative.

At $2,841 per month, the average rent for a one-bedroom in Brookline is 1.9% lower than last year. This comes after years of aggressive rent growth due to high lease-ups and sparse deliveries.

Brookline’s proximity to Boston College, Northeastern University, and Berklee College of Music makes the area appealing to students, and enrollment in these colleges is highly correlated with rent increases. Brookline saw the greatest year-over-year increase in 2021, after Boston College and Northeastern University implemented a test-optional policy due to the COVID-19 pandemic in 2020 that made it easier for prospective students to apply.

Following a nearly 10% increase in student enrollment at the three colleges for the 2021-22 academic year, Brookline’s average rent increased by 5.6% over the 2020-21 year. However, as enrollment begins to stabilize and inventory catches up to student demand, Brookline’s average rent has started to dip. The decline began in the second half of 2025, when rent dropped after a 2.4% increase at the beginning of the year.

February 2026 Rent Growth

Rhode Island had the greatest year-over-year increase at 4%, and Colorado had the largest decrease at -3.3%.

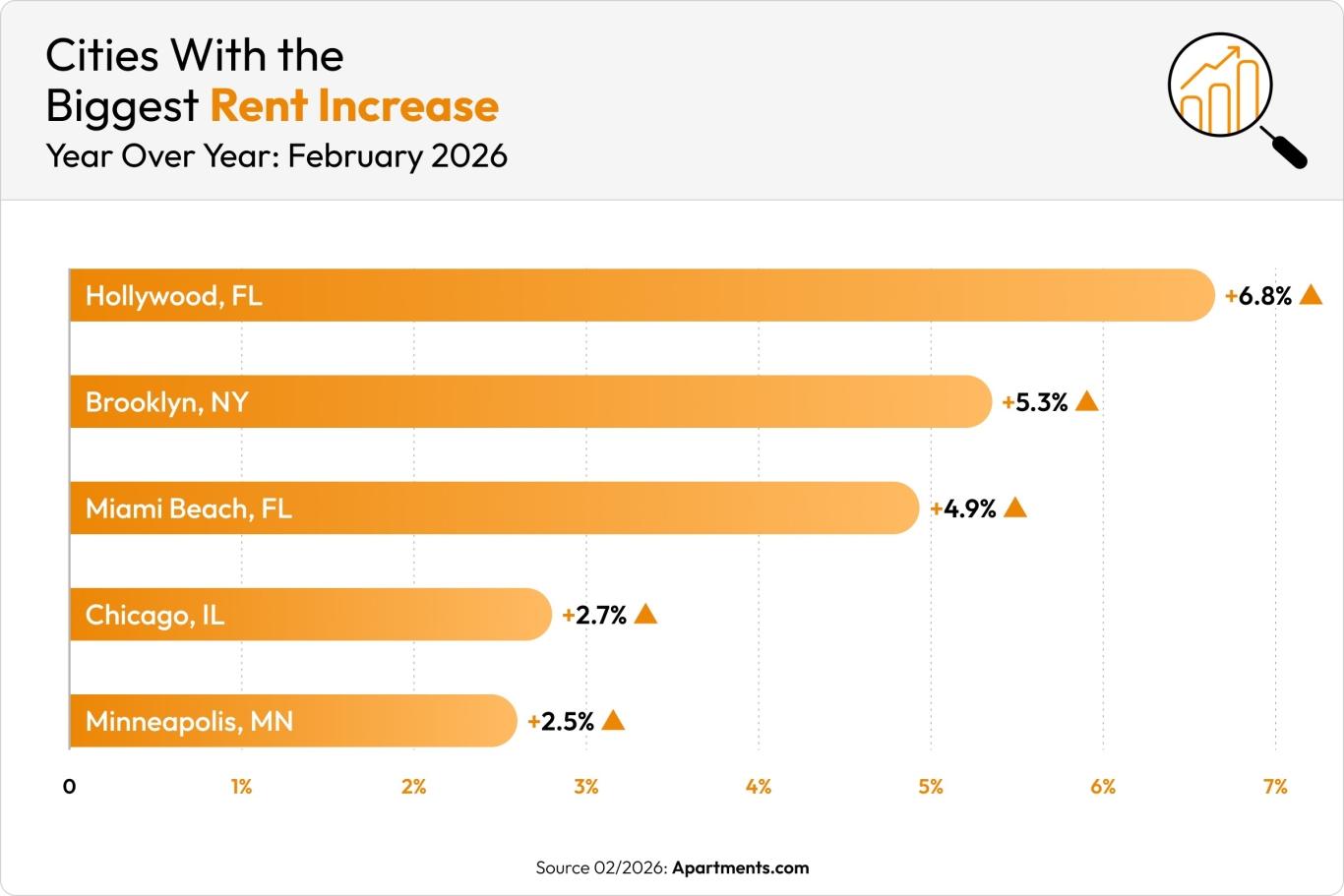

February 2026 rent increases by city

Minneapolis, MN, entered the top five biggest rent increases in February, dethroning New York for the fifth-place spot. Fewer new units entered Minneapolis’ rental market in 2025 compared to years prior, and the city is adjusting to stagnant supply and rising demand with gradual rent increases.

Here are the cities with the biggest rent increases in February:

- Hollywood, FL: +6.8%

- Brooklyn, NY: +5.3%

- Miami Beach, FL: +4.9%

- Chicago, IL: +2.7%

- Minneapolis, MN: +2.5%

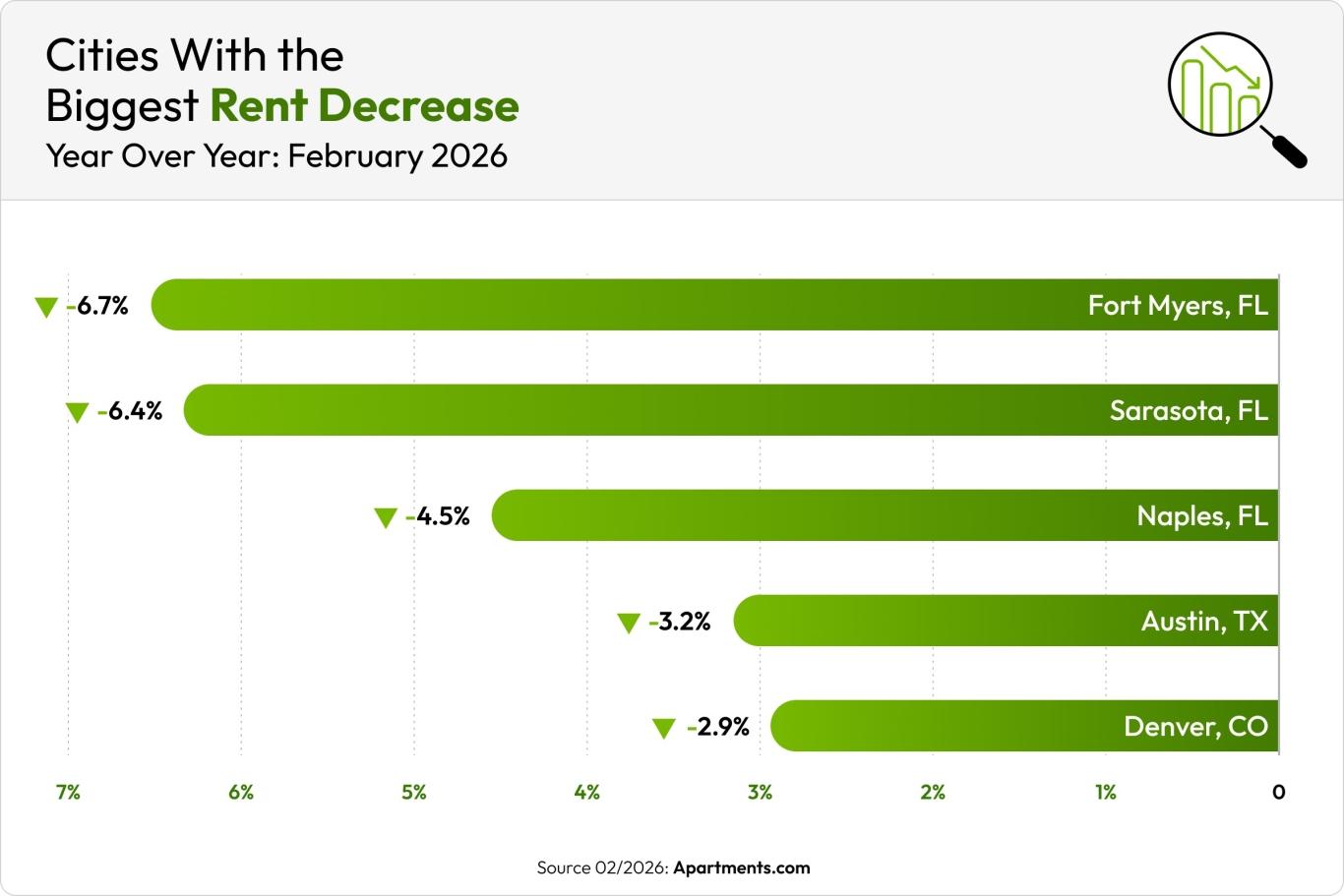

February 2026 rent decreases by city

Florida’s Gulf Coast remains a hotspot for rent decreases as cities battle oversupply. Fort Myers’ vacancy rate is currently 19.7%, Sarasota’s vacancy rate is 17%, and Naples’ is 13.4%. Rents keep falling in these cities as vacancies climb higher.

Here are the cities with the biggest rent decreases in February:

- Fort Myers, FL: -6.7%

- Sarasota, FL: -6.4%

- Naples, FL: -4.5%

- Austin, TX: -3.2%

- Denver, CO: -2.9%

Current Rent Prices Across the U.S.

|

City |

Current Average Rent |

Last Month’s Average Rent |

Year-Over-Year Difference |

|

$2,351 |

$2,332 |

-1.1 |

|

|

$1,613 |

$1,611 |

-0.2% |

|

|

$1,378 |

$1,381 |

-5.1% |

|

|

$3,430 |

$3,410 |

-0.2% |

|

|

$1,627 |

$1,629 |

-0% |

|

|

$2,985 |

$2,985 |

+1.1% |

|

|

$1,798 |

$1,799 |

-1.2% |

|

|

$1,468 |

$1,470 |

-2% |

|

|

$1,989 |

$1,976 |

+2.7% |

|

|

$1,129 |

$1,130 |

+1.5% |

|

|

$1,293 |

$1,291 |

-2.4% |

|

|

$1,151 |

$1,150 |

-0.7% |

|

|

$1,401 |

$1,395 |

-1.7% |

|

|

$1,613 |

$1,612 |

-3.4% |

|

|

$2,239 |

$2,231 |

-0.5% |

|

|

$1,257 |

$1,258 |

-2% |

|

|

$3,785 |

$3,782 |

+2.7% |

|

|

$1,732 |

$1,733 |

+1.8% |

|

|

$1,181 |

$1,180 |

-1.8% |

|

|

$1,113 |

$1,112 |

+0.1% |

|

|

$2,945 |

$2,954 |

+1.7% |

|

|

$1,299 |

$1,299 |

-1.4% |

|

|

$3,180 |

$3,180 |

+0.3% |

|

|

$1,224 |

$1,222 |

+0.9% |

|

|

$1,276 |

$1,271 |

-2.7% |

|

|

$1,816 |

$1,819 |

+0.2% |

|

|

$2,170 |

$2,168 |

-0.4% |

|

|

$1,507 |

$1,488 |

+1.7% |

|

|

$2,206 |

$2,208 |

-0.3% |

|

|

$1,186 |

$1,186 |

+0.5% |

|

|

$1,395 |

$1,391 |

+2.3% |

|

|

$1,654 |

$1,664 |

-3.5% |

|

|

$4,053 |

$4,037 |

+2.3% |

|

|

$1,573 |

$1,581 |

-2% |

|

|

$1,740 |

$1,737 |

+0.2% |

|

|

$1,302 |

$1,311 |

-4.2% |

|

|

$1,405 |

$1,393 |

+1.1% |

|

|

$1,511 |

$1,506 |

-0.6% |

|

|

$3,496 |

$3,486 |

+2% |

|

|

$1,372 |

$1,364 |

-2.7% |

|

|

$1,412 |

$1,403 |

-0% |

|

|

$1,562 |

$1,559 |

-1.4% |

|

|

$1,130 |

$1,126 |

+1% |

|

|

$1,078 |

$1,076 |

-3.1% |

|

|

$2,385 |

$2,385 |

-0.3% |

|

|

$3,213 |

$3,199 |

+6.4% |

|

|

$2,683 |

$2,658 |

+2.4% |

|

|

$2,081 |

$2,081 |

-0.4% |

|

|

$1,637 |

$1,638 |

-3.1% |

|

|

$2,234 |

$2,232 |

-3.5% |

How Current Rent Prices Impact Renters

Rents tend to rise in April and May, as property managers prepare for higher demand over the summer. If you’re planning to move soon, you’ll find good deals in the next month. Beat the traffic and start hunting now!

Need help comparing cities? Our Cost of Living Calculator makes it easy. You can also compare the rent prices from this report to those from January and December to determine the overall trend and visit the U.S. Rent Trends page to view the most current rent prices available across the U.S.

Methodology:

The rent data in this report is sourced from CoStar Group’s Market Trend reports. CoStar Group is the leading authority in commercial real estate information, analytics, and news, trusted by real estate professionals for more than 37 years. By combining this data with Apartments.com internal data and public record, we’re able to deliver the most up-to-date rental information available.

To determine overall rent trends, we evaluate rent prices from more than 2,400 cities across the nation, including the top 80 national markets. This analysis includes year-over-year and month-over-month rent changes to provide a comprehensive view of market dynamics. This report covers a diverse range of property types to ensure a holistic view of the rental market.

FAQs

What is the average rent in the U.S. right now?

The average rent in the U.S. is currently $1,626 per month, a year-over-year increase of 0.4%.

Which states had the largest rent increases in February 2026?

The states with the largest rent increases in February were Rhode Island, Illinois, and Hawaii. Rhode Island’s rent increased by 4% compared to last year, Illinois’ average rent increased by 3.7%, and Hawaii’s average rent increased by 3.3%.

Which states have the cheapest rent right now?

The states with the cheapest rent are Oklahoma, Arkansas, and West Virginia. Oklahoma has the cheapest rent in the U.S. at $909/month.

Are rent prices rising or falling in the U.S.?

Rent prices in the U.S. are rising, averaging 0.4% more than last year.