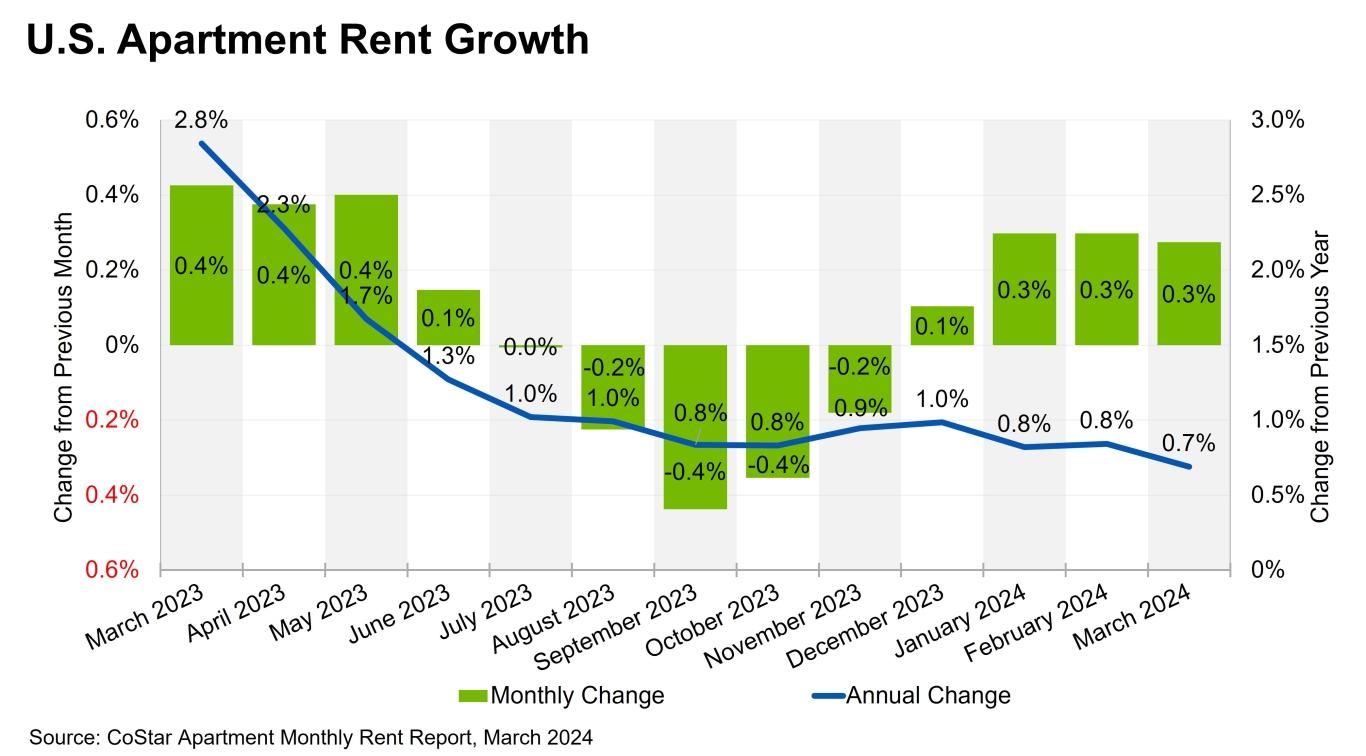

With the first quarter of 2024 behind us, we can get a good idea of the overall rent trends we’ll likely see this year. According to the latest data from the Apartments.com Monthly Rent Report, the vacancy rate ticked up to 7.8% in March. This continues a pattern we’ve seen over the last two and a half years, where the number of empty apartments has exceeded the demand from renters. However, it only rose a fraction of a percent, so it was the smallest increase in 10 quarters, suggesting that the trend is slowing down.

Renters are searching for apartments again, which is helping to balance the vacancy rate. Although more apartments are still coming onto the market than there are renters to fill them, the gap is narrowing. With around 140,000 new apartments recently introduced thanks to the completion of several construction projects, renters have more options to choose from. This surge in availability across various cities is likely to lead to more competitive rent prices and deals for prospective renters.

For Renters, the South Continues to Shine

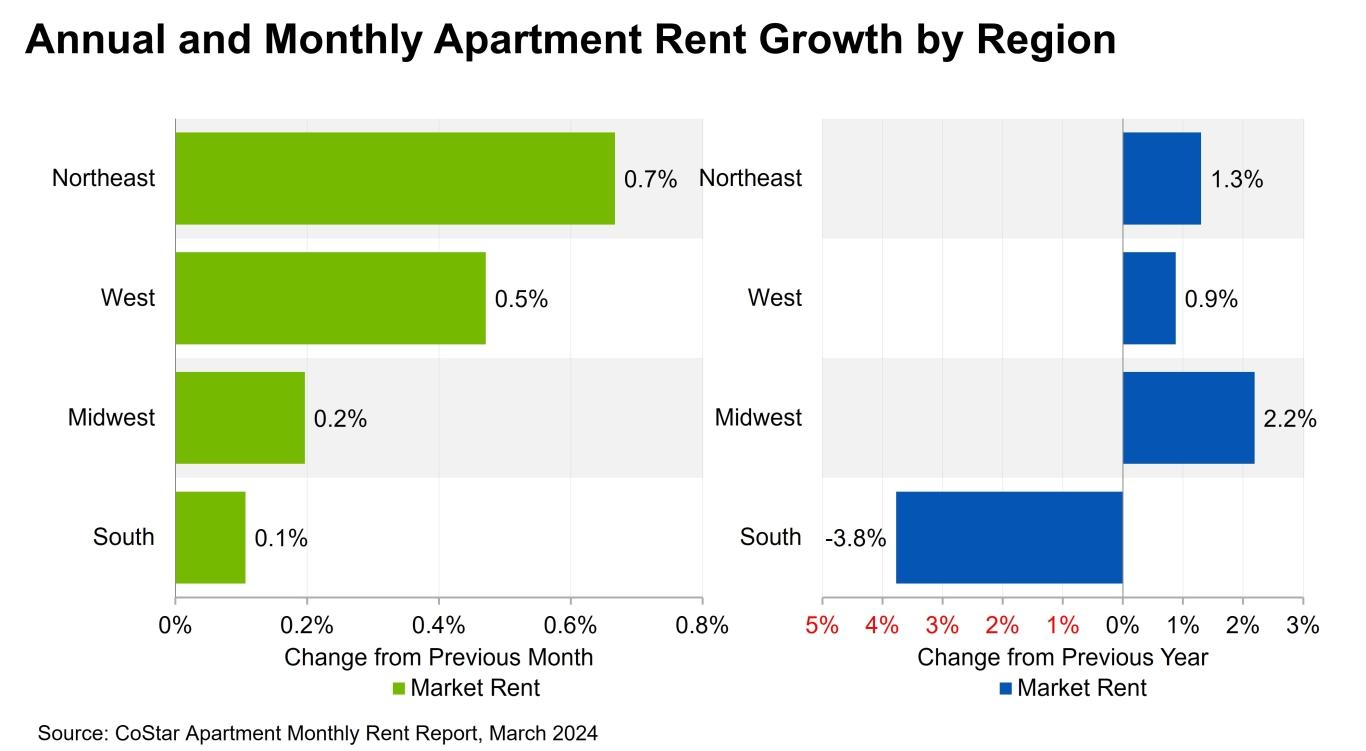

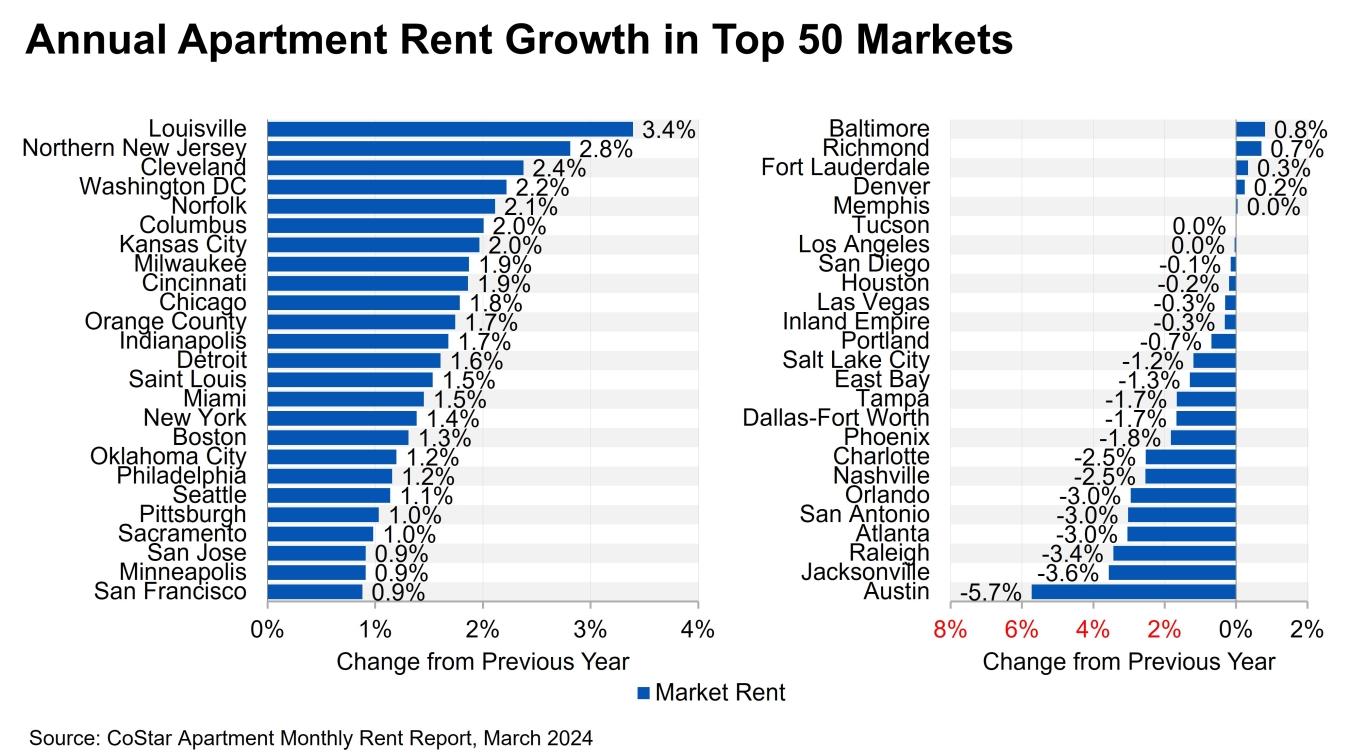

While the overall picture of the rental market is good news for renters, not everyone is feeling the benefits. Those living in the Midwest and Northeast are experiencing a different scenario. Here, due to fewer new construction projects, the availability of rentals hasn’t increased much. The limited supply has led to a steady climb in rent prices. Renters in the Midwest have seen rent go up by 2.2% compared to last year, and those in the Northeast have experienced a 1.3% increase. This contrasts the South, where prices fell -3.8% in the past year.

However, rent prices are showing signs of stabilization, even in the South. In February, rent was down in the Southern region -0.2%. In March, it was still down, but only by -0.1%. This slowdown is a result of the construction of new apartment buildings tapering off. Looking ahead, it’s projected there will be 20% fewer apartments hitting the market, with only 495,000 new units expected to become available this year. While this doesn’t necessarily mean rents could start climbing in the South, they might not decrease as dramatically as we’ve seen in prior months.

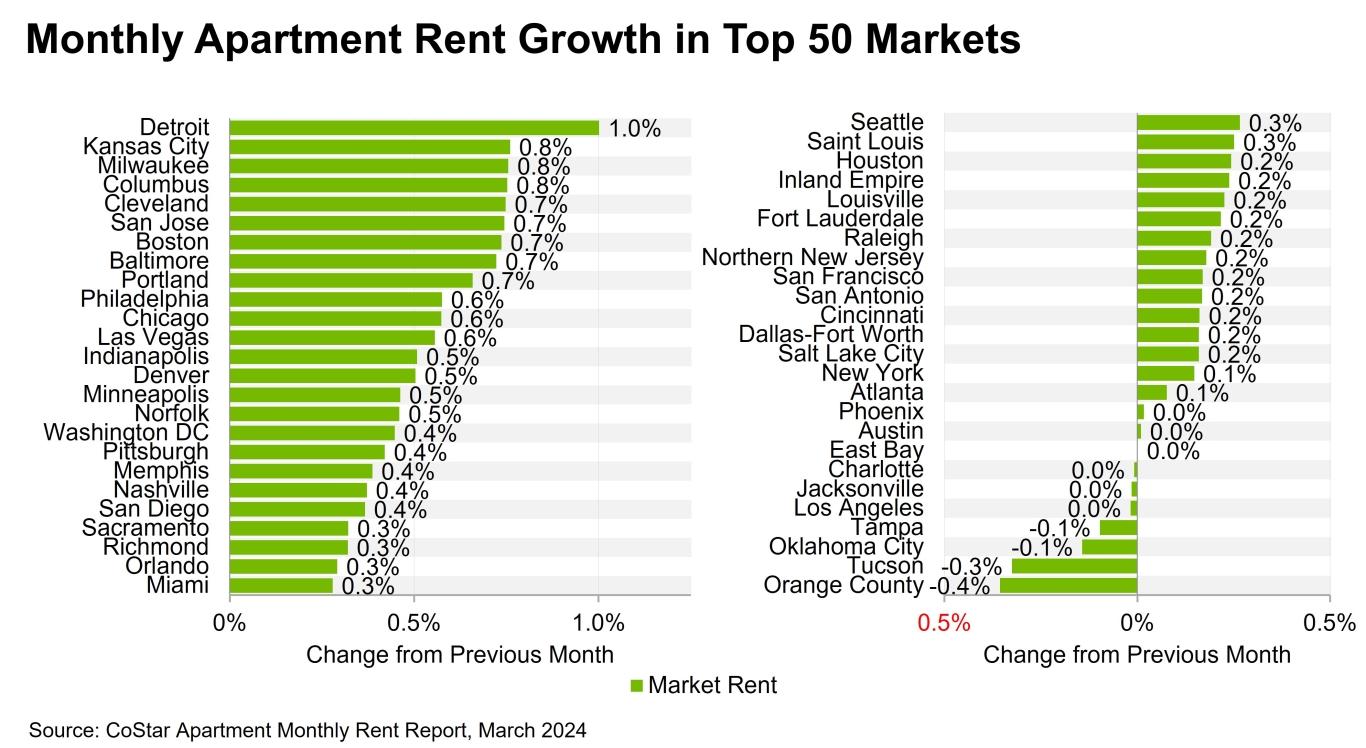

Cities with the Biggest Rent Increases

In February, the city with the biggest increase in rent prices was Louisville, Kentucky. Rent prices have been steadily climbing in Louisville. At the beginning of the year, rents were up 0.8%. In February, they rose 0.9%. And in March, renters in Louisville saw rent prices rise another 0.2%. While this increase was much smaller, it still helped Louisville reach a year-over-year rent increase of 3.4%, the largest increase of the top 50 markets nationwide. To put that into perspective, the next largest year-over-year increase was in Northern New Jersey, an area that saw rent prices increase by 2.8%.

While Louisville tops the list for the biggest annual increase, another city tops the list for month-over-month increases: Detroit, Michigan. In March, Detroit was the only city to see rent prices increase by a full percentage point. In February, Detroit’s modest 0.4% increase in rent prices didn’t even place it in the top 15.

Here are the five cities with the biggest rent increases for March 2024:

1. Detroit, Michigan (+1.0%)

2. Kansas City, Missouri (+0.8%)

3. Milwaukee, Wisconsin (+0.8%)

4. Columbus, Ohio (+0.8%)

5. Cleveland, OH (+0.7%)

Cities with the Biggest Rent Declines

Last month, Austin, Texas topped our list of cities with the biggest rent declines, falling -0.4%. In March, rent prices were flat. However, Austin is still the city with the biggest decrease in rent prices year over year, down -5.7 percent.

This month, Tucson, Arizona tops the list with a rent decrease of -0.3%. This follows last month’s -0.1% decline. Looking at the bigger picture, renters aren’t seeing much difference in rent prices. Year over year, rent prices haven’t changed, sitting at 0.0%.

Surprisingly, Austin fell out of the top five, and a new city found its way onto the list of cities with the biggest rent decreases: Los Angeles, California. But while it made the list, renters in California aren’t seeing a drop in rent. Instead, rent prices are flat, a monthly trend as well as an annual one.

Here are the cities with the biggest rent declines for March 2024:

1. Tucson, AZ (-0.3%)

2. Oklahoma City (-0.1%)

3. Tampa, FL (-0.1%)

4. Los Angeles, CA (0.0%)

5. Jacksonville, FL (0.0%)

Balance in the Rental Market

In March, rent prices fell in only a handful of markets, and then only slightly. Only Detroit, Michigan saw rent prices increase more than a percentage point. With only slight fluctuations, this could indicate a trend toward a more balanced market in 2024. According to the Rent Trends Report, most of the construction was for luxury apartment buildings. With more apartments available and less demand for these types of rentals, rent for luxury apartments at the end of March was at -0.3%. This decline is the opposite of what’s happening with mid-priced apartments, where fewer new apartments and a higher demand saw rent prices grow 1.3%.

The demand for budget apartments was the weakest of all market segments. This is due to renters at this price point struggling with higher housing costs and the rising costs of everyday items, moving them out of the rental market in favor of moving in with roommates or choosing to live in a family home.

Current Rent Prices Across the US

Want to see what rents are doing where you live? Here’s a look at the current rent prices in cities across the country:

|

City |

Current Average Rent |

Last Month’s Average Rent |

Year-Over-Year Difference |

|

$2,257 |

$2,238 |

+0.74% |

|

|

$1,559 |

$1,552 |

-4.75% |

|

|

$1,438 |

$1,438 |

-7.46% |

|

|

$3,331 |

$3,314 |

+1.08% |

|

|

$1,584 |

$1,578 |

+0.43% |

|

|

$2,652 |

$2,652 |

+1.39% |

|

|

$1,688 |

$1,683 |

-1.51% |

|

|

$1,416 |

$1,416 |

-3.37% |

|

|

$1,815 |

$1,790 |

+0.17% |

|

|

$1,024 |

$1,024 |

+1.23% |

|

|

$1,297 |

$1,309 |

-2.41% |

|

|

$1,082 |

$1,081 |

+0.75% |

|

|

$1,362 |

$1,356 |

-3.00% |

|

|

$1,684 |

$1,680 |

-0.99% |

|

|

$2,185 |

$2,157 |

+1.17% |

|

|

$1,233 |

$1,232 |

-2.21% |

|

|

$3,576 |

$3,515 |

+1.96% |

|

|

$1,668 |

$1,652 |

+1.19% |

|

|

$1,155 |

$1,152 |

-0.79% |

|

|

$1,043 |

$1,042 |

+1.17% |

|

|

$2,754 |

$2,799 |

-3.51% |

|

|

$1,278 |

$1,276 |

-4.05% |

|

|

$2,976 |

$2,976 |

+0.28% |

|

|

$1,129 |

$1,119 |

+0.62% |

|

|

$1,252 |

$1,246 |

-1.29% |

|

|

$1,718 |

$1,718 |

+0.43% |

|

|

$2,091 |

$2,092 |

-0.96% |

|

|

$1,378 |

$1,378 |

+4.73% |

|

|

$2,063 |

$2,051 |

+1.10% |

|

|

$1,111 |

$1,102 |

+1.07% |

|

|

$1,321 |

$1,321 |

+0.54% |

|

|

$1,595 |

$1,589 |

-4.10% |

|

|

$3,748 |

$3,748 |

+1.84% |

|

|

$1,551 |

$1,546 |

-3.12% |

|

|

$1,648 |

$1,644 |

-0.43% |

|

|

$1,304 |

$1,310 |

-2.74% |

|

|

$1,268 |

$1,267 |

-0.73% |

|

|

$1,473 |

$1,460 |

-0.78% |

|

|

$2,324 |

$2,322 |

+0.63% |

|

|

$1,340 |

$1,340 |

-5.33% |

|

|

$1,314 |

$1,302 |

+0.78% |

|

|

$1,496 |

$1,493 |

-0.35% |

|

|

$1,052 |

$1,051 |

+0.90% |

|

|

$1,078 |

$1,073 |

-3.16% |

|

|

$2,251 |

$2,248 |

-1.43% |

|

|

$2,833 |

$2,822 |

+0.69% |

|

|

$2,487 |

$2,466 |

+0.02% |

|

|

$1,995 |

$1,986 |

-1.00% |

|

|

$1,594 |

$1,582 |

-1.61% |

|

|

$2,231 |

$2,226 |

+0.92% |

How Current Rent Prices Impact Renters

While rent prices appear to be leveling off, it’s possible they could start increasing again, especially for those in the mid-tier price range. Since many of the apartment communities nearing completion are in the luxury category and demand for luxury apartments is down, renters looking for apartments at this price point may find better value when searching for apartments. However, those searching for mid-priced apartments may find fewer available units and more competition, which could drive prices up.

In addition to the type of apartment you may be searching for, location is a major factor to consider. Those in the South may continue to find rent prices trending downward, while those in the Northeast and Midwest may see rent prices continue to climb, albeit at a much smaller pace. However, the wild fluctuations we saw in 2022 and 2023 appear to be over.

If you are thinking about moving, knowing what rent prices are doing in your area can help you determine when and where to move. It can also help you decide what type of apartment would work best for your budget. Be sure to watch for rent specials and deals, especially in locations with higher vacancy rates. Compare the rent prices from this report to those from February and January to determine the overall trend and visit the US Rent Trends page to view the most current rent prices available across the US based on CoStar data.