Rent is one of your biggest expenses, so it’s important to determine how much of your income should go towards it to prevent overspending. You also should consider other expenses and how much you want to put into your savings. With so many parts, figuring out your spending can be difficult, which is why budgets exist. Budgets set guidelines on how much you should spend in certain categories.

Key Takeaways

- Aim to spend no more than 30% of your gross income on rent to stay within a healthy financial range.

- Use the 50/30/20 budgeting rule to balance rent and other expenses: 50% for essentials, 30% for wants, and 20% for savings.

- Factor in additional housing costs, like utilities, pet fees, and move-in expenses, as these can push your rent budget beyond 30%.

How Much Rent Can I Afford?

Generally, you should spend about 30 percent of your gross income (before any deductions or taxes are withheld) on rent. Depending on your priorities, lifestyle, and location, you may decide to spend more or less. If you spend a lot of time at home, you may want to spend more time to get a bigger place. On the flip side, if you travel a lot, you might spend less on rent. Location is also a huge factor, as some cities are expensive.

The 30 Percent Rule

The 30 percent rule says you should spend approximately 30 percent of your gross income on rent. To calculate how much 30 percent of your income is, follow these steps:

- Gross Yearly Income × .3 = Yearly Rent Amount

- Yearly Rent Amount ÷ 12 = Monthly Rent Amount

For example, if you make $50,000 a year, you would do these calculations:

50,000 × .3 = 15,000

15,000 ÷ 12 = 1,250

If you make $50,000 a year, you should spend about $1,250 on rent a month.

Once you’ve decided how much you want to spend on rent, you should look at how it fits into your overall budget. If you have a lot of other expenses, like student loans or car payments, you may need to spend less than 30 percent on rent. On the other hand, if you don’t have a lot of monthly payments, you could spend a higher percentage of your living expense budget on rent.

50/30/20 budget

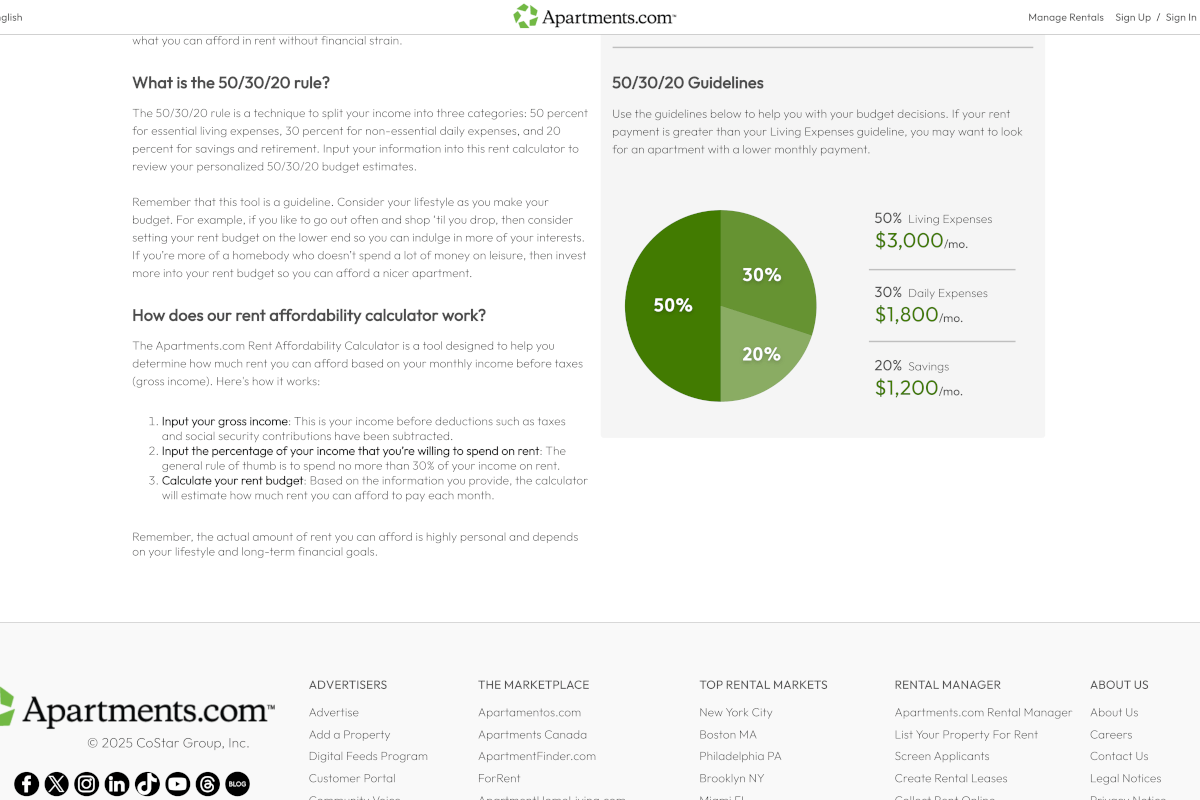

To help you stick to your plan, the 50/30/20 budget organizes your budget into three categories. Each category has a suggested percentage that you spend money on:

- 50 percent for living expenses: add any necessities, like rent and utilities, to this category.

- The 30 percent for rent falls within the 50 percent for living expenses.

- 30 percent for wants: things you would like, such as new clothing, streaming subscriptions, and going out, fall into this category.

- 20 percent for savings: whether you are putting it towards retirement or an emergency fund, saving prepares you for anything that the future throws at you.

These percentages are good guidelines, but depending on your situation, you may want to change them a bit. Your budget is flexible, so it can best fit you. For example, If your other expenses are lower, you could spend more on rent. As long as you are being financially responsible, you can tailor your budget to your lifestyle.

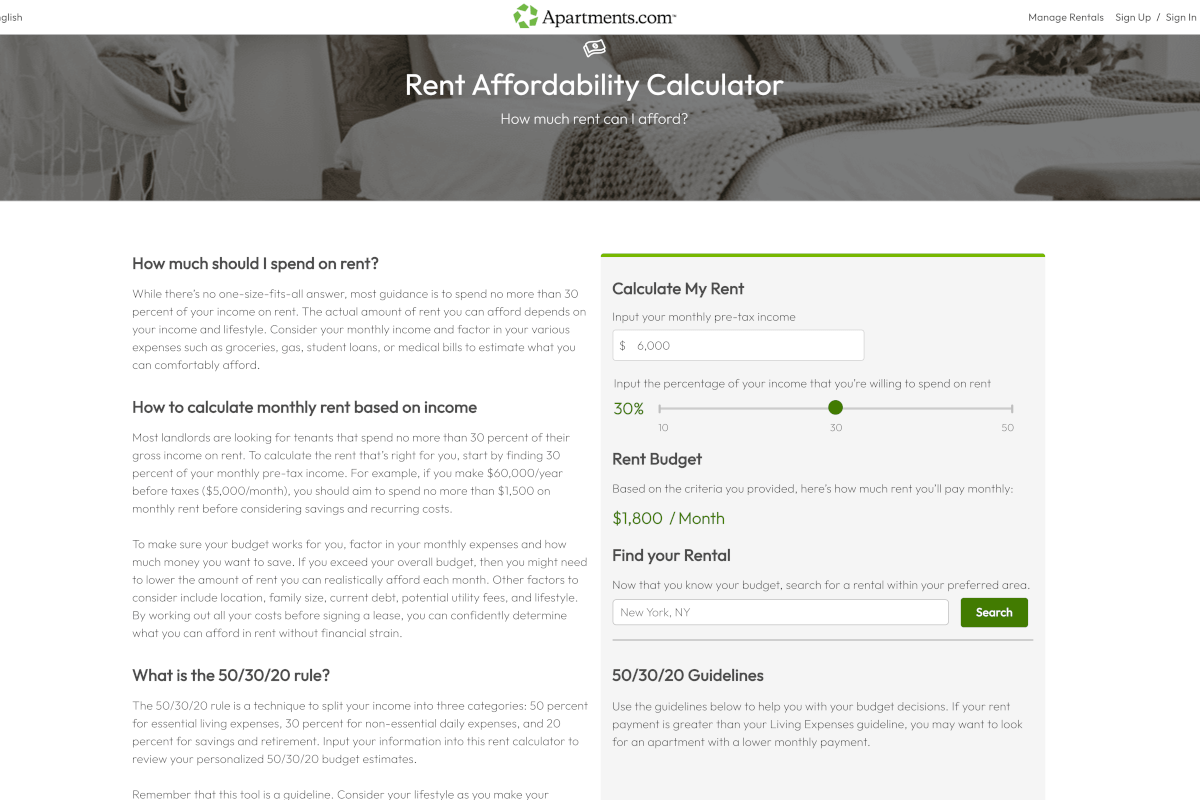

How Do I Calculate My Rent with a Rent Calculator?

When figuring out your apartment budget, Apartments.com makes visualizing and sticking to it easy with the Rent Calculator. It calculates how much you should spend on rent depending on what percentage of your monthly income you choose to allocate. You can choose anything from 10 percent to 50 percent.

How to use the Rent Calculator on Apartments.com

When you go to the page, you will start by inputting your monthly income into the box and dragging the slider to choose the percentage of income that you want to spend on rent. It will give you your rent budget so you know how much rent you can afford. To find apartments within that budget, you can input your preferred area, and then it will take you to the search page with that budget filter.

The rent calculator helps you picture your budget when following the 50/30/20 guidelines. Budget information is displayed in a pie chart, making it easier to see how each category relates to your monthly income. It gives the exact amounts for each category, calculated according to the monthly income input.

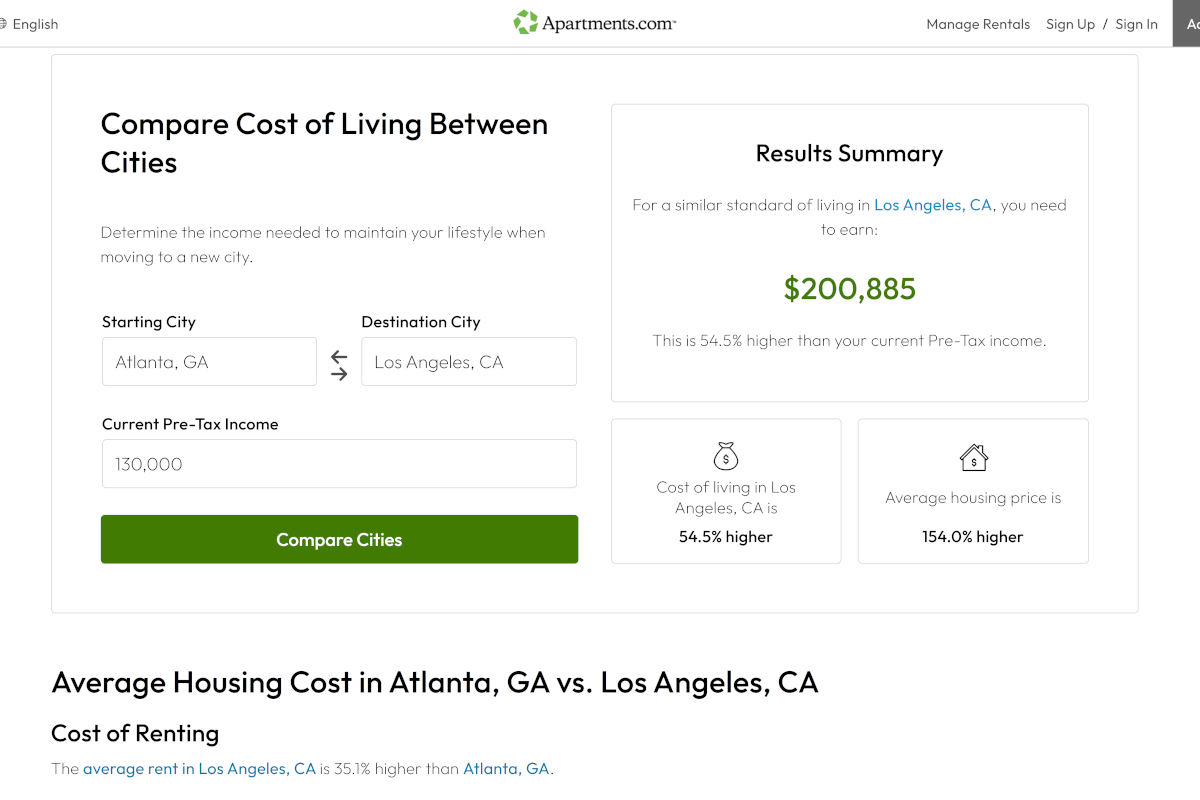

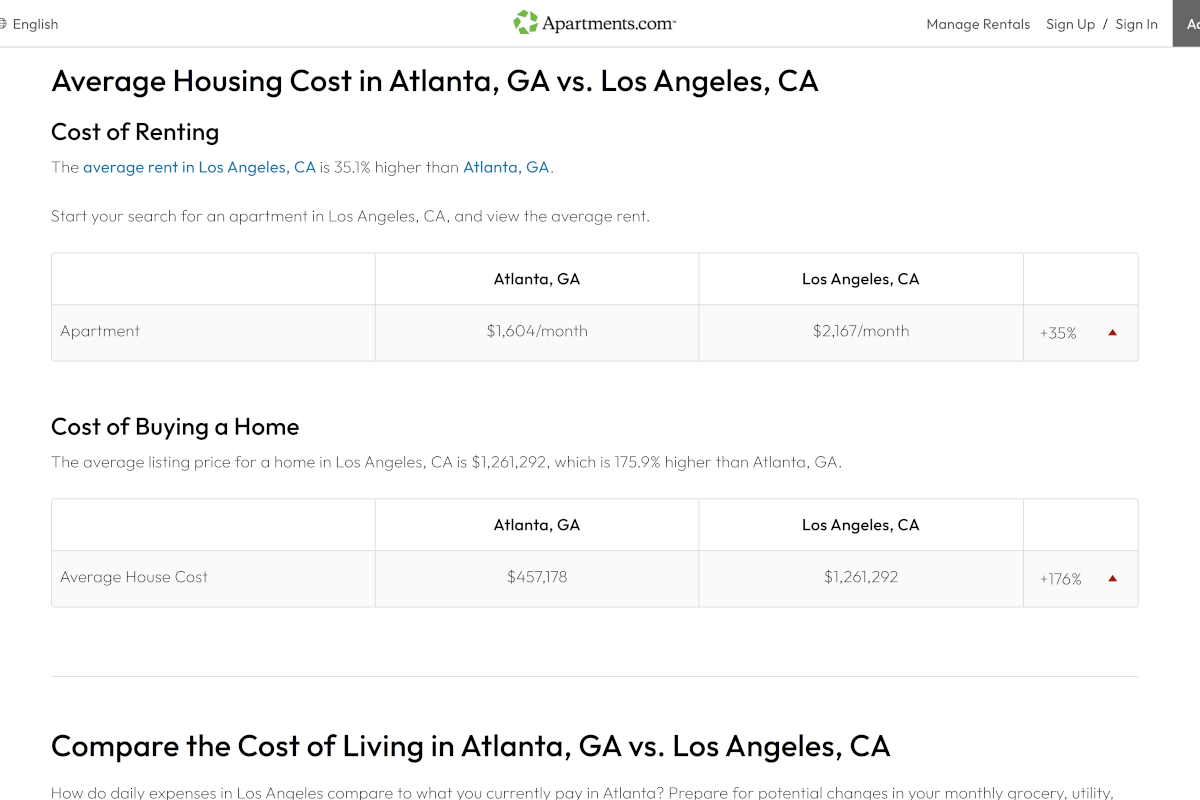

Compare the Cost of Living in Two Cities

If you are moving cities, use the Cost of Living Calculator on Apartments.com to compare the starting and destination cities. The calculator determines how much you need to make to keep a similar lifestyle in the destination city. To start, input your starting city, destination city, and current pre-tax income.

Once you hit the “compare cities” button, the calculator will tell you how much you would need to earn in the destination city to keep a similar living standard under the results summary. Also included is the percentage difference of the result to your pre-tax income, the cost of living in the destination city, as well as the average housing price.

You can find a variety of comparisons for the cost of living, including the cost of renting, the cost of buying a home, groceries, utilities, healthcare, transportation, and more. It will tell you about the average for both cities and their percentage difference. Once you’ve explored all the comparisons, you can start finding houses and apartments for rent in the destination city, as it will give some suggestions for each.

How Much Do Apartments Cost?

While rent may be the biggest expense, there are other fees that contribute to the total cost of an apartment. Utilities, move-in fees, and more need to be factored into your budget when considering how much you can spend on living expenses.

What is a move-in fee?

When you are moving, there are often move-in fees, a security deposit, and more that you need to factor into the total cost of renting. Move-in fees are one-time payments you will pay before or on move-in day. They are typically not added to your monthly rent. However, you will still need to budget for these costs to be sure you have enough money for all moving expenses.

Move-in fees include:

- Application Fee

- Administration Fee

- Security Deposit

- First Month’s Rent

- Pet Fee/Deposit

How much are utilities every month?

While they may not be added to your rent price, you need to factor utilities into your budget. Utilities are monthly payments that include:

- Gas

- Electricity

- Water

- Sewer

- Trash (valet or basic)

- Internet and Cable

- Pest Control

How much your utilities are and how you pay them depends on whether they are included in your rent or if you are charged separately by the provider, either at a flat rate or based on usage. It could be a mix of both. For instance, your apartment community could include a flat rate for water, trash, sewage, and pest control in your monthly rent. But you can’t forget your gas, electricity, and internet/cable providers.

Ask the property manager or landlord how they handle and split up utilities before you sign the lease. If you don’t have a ballpark number for how much you’ll be paying each month for utilities, you could end up paying more than you anticipated.

This article was originally published by Megan Bullock on February 22, 2019.

FAQs

Do apartment communities count my roommate’s income too?

If you’re signing a joint lease, all incomes are added together to determine if you meet the income requirements. For example, if your potential landlord’s income requirement is four times the monthly rent, your income and your roommate’s income will be added together to determine if you meet the criteria.

Having a roommate could be the perfect solution to getting a more expensive place while still having a lower rent as long as you don’t mind sharing. Make sure to discuss a budget with your roommate to make sure you are both happy with how much you are spending and what you are looking for.

How much rent can I afford on $50k?

On a salary of $50,000/year, you will be taking home a gross income of $4,167 per month. Since rent should generally be no more than 30 percent of your monthly gross income, you can afford a rent of $1,250 monthly.

How much rent can I afford on $60k?

If you earn $60,000 a year, that is a monthly income of $5,000 before taxes. In accordance with the 30 percent guideline, about $1,500 a month should be spent on rent.