Flash floods, freeze warnings, strong winds, tropical storms - words that can make any renter's or homeowner's heart sink. When disaster strikes, residents often find themselves at the mercy of the storm. Those who have lived through a natural disaster and had their home affected know that all the precautions and insurance in the world doesn't stop the creep of water through the basement or steady the tree wobbling dangerously close to the roof.

When you're left feeling helpless and temporarily houseless, the last thing you want to worry about is where you're going to stay while your home is repaired. Thankfully, short-term rental options are available for those seeking refuge from a flooded apartment or wind-struck rental. Knowing where and how to look will help you find a safe place to stay while you and your home recover.

Contacting Insurance After a Natural Disaster

The first step after your home has been damaged by flood, fire, or freeze is to contact your homeowners or renters insurance. These policies are in place to help reimburse personal belongings and temporarily relocate residents.

Does homeowners insurance cover temporary housing?

Many homeowners' insurance policies include loss of use coverage, which simply covers living costs if your home is uninhabitable due to disaster. Loss of use coverage may reimburse the following costs and many more:

- Temporary hotel or apartment residence

- Moving fees

- Storage costs

Loss of use does not cover the mortgage of your damaged home – just the additional costs related to your temporary relocation. You must continue to make payments while your residence is repaired.

Also, keep in mind that your temporary rental must be similar to your permanent residence to qualify for insurance coverage. (If you own a two-bedroom home in the suburbs, insurance most likely will not reimburse a stay in a Beverly Hills mansion.)

Does renters insurance cover temporary housing?

Similarly to homeowners, many renters qualify for temporary relocation coverage under their insurance policies. Just like loss of use coverage, temporary relocation coverage is for additional living costs after being displaced from your primary place of residence due to uninhabitable conditions (typically associated with an incident or disaster). For a full list of covered incidents, review your renters insurance policy or contact a member of the company.

If your unit is not livable, you may not be responsible for rent payments while you are displaced. Always contact your property manager to determine whether you are responsible for monthly payments.

How long does your property manager have to make repairs?

Many states allow property managers a “reasonable time” to make repairs after an incident, though few define how long that time is. “Reasonable time” differs based on the severity of the damage.

When are you able to break your lease due to property damage?

Many lease agreements include a “force majeure” clause, which absolves both parties of their legal and contractual obligations following an unforeseen or “extraordinary” event. If your property manager is reasonably unable to repair your rental after severe weather, you will most likely be within your right to terminate your lease without penalty. To understand your rights moving forward, consult your lease agreement and property manager.

*The overview above is not legal advice, nor is it applicable to all homeowners or renters. For a full understanding of your coverage and rights, contact your insurer and property manager.

Finding the Right Short-Term Apartment

Should you opt for a stay in a short-term rental instead of a hotel, there are a few things to consider.

Price

Rent is one of the top considerations when searching for a short-term apartment. Insurance most likely has a cap on reimbursement, so it’s important to look for a place that best aligns with your available coverage.

Documentation

Applying for a short-term apartment is much like applying for any other rental. Before you get started, gather the right papers to streamline the process:

- Proof of income: Paystubs and tax returns are usually sufficient to show that you are making enough money to qualify as a renter.

- Credit report: Credit reports show property managers a renter’s eviction records and any history of repeated late payments.

- Proof of insurance coverage: If you intend to use renters or homeowners insurance to cover your stay, make sure you have a letter from your agent stating that you are a displaced resident and will be reimbursed for rent.

Month-to-month or short-term lease

Know what you’re signing before you sign it! A month-to-month lease, as the name implies, renews every 30 days. Month-to-month leases offer the most flexibility in terms of a smooth exit but are also subject to unannounced price increases and sudden termination of the agreement by the property manager.

A short-term lease is a little less flexible but offers more stability overall. During the lease period (be it two, three, or four months), rent cannot be increased, and renters cannot be dismissed from the property except in the case of a lease violation.

Know where to search

You can find short-term apartments in the same places you search for other rentals – it just may require an extra click or two to get what you’re really looking for.

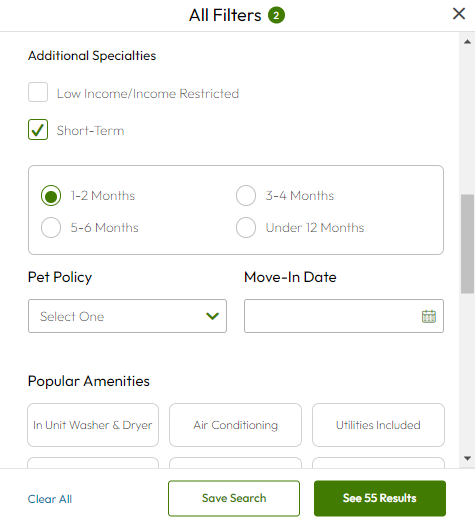

On Apartments.com, you can explore a selection of available short-term rentals. From the homepage, navigate to your desired location.

In the far right of the navigation ribbon, select “All Filters,” then scroll down to “Additional Specialties.” From there, you can select the short-term option and your preferred lease duration.

Upon clicking “See Results,” you can explore all available short-term rentals in your area that match your selected lease length. From there, you have the option to click on listings, view photos and neighborhood details, and even request a tour or send a message to a property manager or leasing agent.

Finding Immediate Emergency Housing After a Natural Disaster

In some cases, the damage following a natural disaster may be so severe that residents aren't able to find a short-term apartment or nearby hotel. Depending on the severity of the damage in your location, you may qualify for government programs or financial aid as you search for shelter. USA.gov outlines various resources available to those who are living in a "presidentially declared disaster area."

FEMA temporary housing

FEMA, or the Federal Emergency Management Agency, is a government program that aids Presidentially declared disaster victims. If you qualify for FEMA assistance (you can apply at DisasterAssistance.gov), you may be eligible for:

- Temporary housing stipends, either in the form of rent or reimbursed hotel costs

- Temporary housing units (in the case of unavailable hotels or rentals)

- Financial assistance to restore an owned home back to habitable conditions

FEMA assistance is available only to those whose home is uninhabitable due to a natural disaster and who are ineligible for insurance coverage.

Red Cross temporary housing

American Red Cross is another program that works to provide disaster relief to those displaced by storms or lacking "essential services." If you're in need of emergency housing, the Red Cross provides an online map of open shelters across the US. Shelters provide a place to sleep, first aid, and resources to plan for your financial recovery.

How can I find emergency housing without internet?

In the aftermath of disaster, many areas may be without power for days to weeks on end. If you are unable to access the internet to search or register for temporary housing, there are still ways to access the right resources. In all 50 states, you can call 211 from a cell phone or landline to get in touch with a trained professional who will direct you to essential services and the nearest shelter.