Is the American dream of homeownership becoming outdated? Today, more and more people are choosing a rent forever lifestyle, opting for less responsibility, less stress, and a lighter financial load. But is it right for you?

While renting forever shows a shift from the long-held American dream pursuit of homeownership, modern renters see it as a more flexible option that provides them with more options to live a lifestyle they choose. With the rewards for long-term renters, those who opt to rent forever can obtain a lower cost of living than others who choose ownership.

We surveyed American renters aged 18+ to learn more about the motivations behind the choice to rent forever. We found that while many respondents want the reduced stress of renting property, many young millennials and Gen Z renters have different motivations to pursue and benefit from the trend than older renters.

Continue reading for our takeaways and findings about the rent forever phenomenon.

Key Takeaways

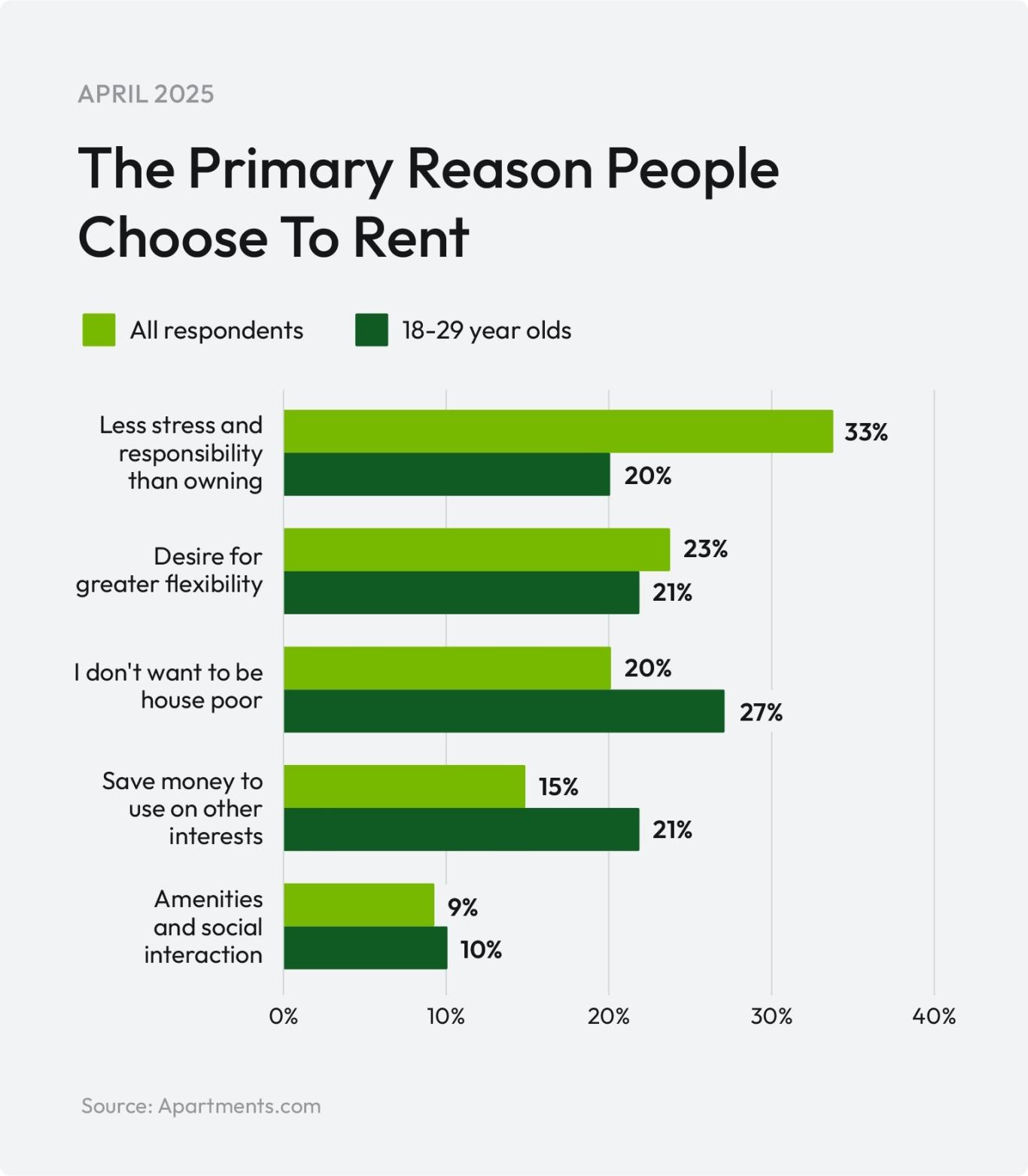

- Renting forever is a conscious choice for 33% of respondents who choose to rent for less stress and responsibility, but for 27% of 18-29-year-olds, renting helps them prioritize not being house poor.

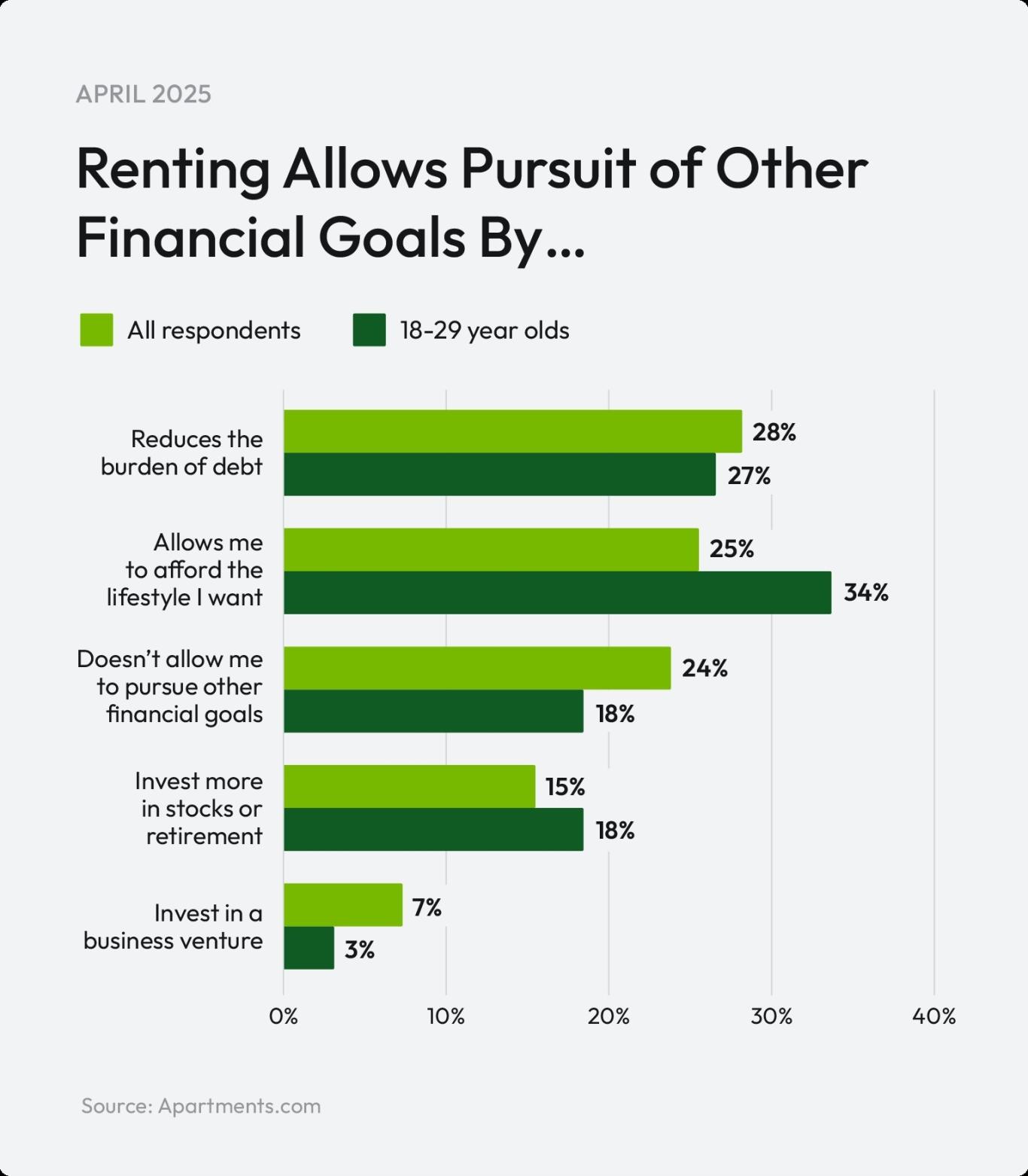

- Renting is a path toward financial stability with 28% of respondents saying renting reduces the burden of debt, and 34% of those aged 18-29 sharing that it helps them live the lifestyle they want.

- 35% of renter respondents say they feel less stress due to the reduced financial burden of renting.

- Renters choose comfort and convenience: 34% of respondents share that renting contributes to their desired lifestyle by providing less responsibility than homeownership.

Renting Means Lower Stress and More Time Doing What You Love

For many people, renting is no longer just a fallback option because they can't afford a house — it's consciously choosing a stress-free lifestyle where they can invest more time and money in the things they enjoy. This paradigm shift is turning the traditional American dream of owning a home on its head. As people's values and priorities shift away from owning to focus on other financial goals and dreams, there’s a significant trend toward renting forever and its benefits.

While there are many reasons someone decides to lease long-term, we focused specifically on why people are choosing to rent instead of own. The primary reason one-third (33 percent) of respondents choose renting is less stress and responsibility than owning a home.

Further highlighting a shift in priorities and values among people, other respondents shared their primary reason for renting as:

- A desire for greater flexibility and freedom to relocate (23%)

- Not wanting to be house poor (20%)

- Saving money to use on other interests (15%)

- Access to more amenities with greater social interaction (9%)

However, the primary reasons why millennials rent shift significantly when looking at those who are at the cusp of being Gen Z.

The primary reason why respondents aged 18-29 choose to rent is not wanting to be house poor (27 percent). With 22 percent of people fitting the description of “house poor,” it shouldn’t come as a surprise that this age group wants more disposable income instead of money tied up in housing costs. This means that this age group sees an advantage of renting as having disposable income to live comfortably and not being tied up in homeownership costs.

However, a bigger reason for this age group’s desire to rent is their shift in values. They have seen generations before them invest in homes, but due to the rising cost, they no longer feel homeownership is financially viable.

Further showing this age group's desire for freedom related to their finances and lifestyle, their next reasons for renting are:

- It allows them to save more money to use on other interests (21%)

- The desire for greater flexibility (21%)

- To seek less stress and responsibility than owning a home (20%)

- Desire for access to more amenities and social interaction (10%)

Renting, the New Financial Strategy: Reduce Debt and Invest in Your Lifestyle

For many, renting is a deliberate strategy to create wealth and live a desirable lifestyle. Owning a home was once one of the most popular strategies to build wealth, but the generational shift from building real estate equity is evident.

Our survey shows that 28 percent of respondents believe that renting reduces the burden of debt, allowing them to pursue other financial goals or investments. These respondents prove that many view renting as financially smarter than purchasing a home. One of the benefits of renting is that it can free up cash for travel, investing, or passion projects. This way of thinking showcases that owning a home isn’t the only path to financial stability.

This was followed by:

- 25% said they can afford the lifestyle they want, like traveling and going out with friends, showcasing the importance of non-essential want-based spending

- 15% shared that renting allows them to invest more money in stocks or retirement, showcasing the lasting priority of making smart investment choices

- 7% said it allows them to invest in a business venture

However, almost one-quarter (24 percent) of respondents said that renting does not allow them to pursue other financial goals. There are many reasons for this, including the fact that rent for a one-bedroom apartment has increased 65 percent since 2000, according to CoStar. Additionally, the amount people spend on rent depends on the location, the cost of living, the percentage of earnings spent on rent, and more.

Because of this, it’s worth monitoring current rental market trends to determine the cost of renting in your area compared to national averages.

Experiencing life, on their terms, is more important to younger renters, as the pursuit of other financial goals or investments also differs in priority for those aged 18-29. More renters in that age group (34 percent) emphasize that renting allows them to afford the lifestyle they want.

Whether this lifestyle includes travel, social activities, or pursuing personal passions, they contribute significantly to their overall quality of life and sense of fulfillment. Many younger adults want to live for now instead of delaying experiences. Being unburdened by homeownership's financial and logistical commitments is a key factor in their housing choices and a direct investment in their well-being.

Younger renters are also more optimistic and aware of the financial advantages of renting than older generations, as they acknowledge how renting reduces their debt burden (27 percent), which is understandable as they experience higher levels of other debts.

More respondents in this age group (18 percent) shared that renting allows them to invest more in stocks or retirement. However, fewer (3 percent) said it allows them to invest in a business venture.

This shows that this age group is slightly more optimistic about the rental market and its affordability than others.

Lower Financial Burden Allows Renters to Feel Less Stressed

We’ve already mentioned that people choose to rent for less stress, but what specific factors ease stress? A significant contributor is the reduced burden of homeownership responsibilities. Renters trade building equity for the peace of mind that comes with not being directly responsible for costly and time-consuming maintenance, repairs, and property taxes.

Knowing that a leaky roof or a broken appliance is the landlord's responsibility can alleviate considerable financial and emotional strain. This exchange allows renters to focus their time and energy on other aspects of their lives.

The reduced financial burden is why 35 percent of renters say that renting has reduced overall stress levels. This means that renters are ditching the worries of broken water heaters, roof replacement, property taxes, and surprise home repairs for peace of mind — a smart move since 46 percent of homeowners spent over $5,000 for unexpected repairs in 2024, according to Hippo’s Housepower Report. With more money at their disposal, renters can participate in money-saving challenges to contribute to larger purchases or to build emergency funds to further reduce stress.

Other responses to the reasons that renting reduces overall stress were:

- Reduced responsibilities compared to owning a home (27%)

- Not worrying about lawn maintenance or shoveling (11%)

- Not worrying about property value fluctuations (11%)

Notably, a small 8 percent of respondents shared that renting increases their overall stress levels. Higher stress levels and anxiety are linked to those who spend more than the recommended 30 percent of their income on rent, as discovered by a 2021 report.

Explore with Freedom to Move and Freedom to Live by Renting

Renters are prioritizing the freedom to live where they want, whether near work, culture, or fun, without being tied down. Renting is becoming the modern way to stay agile and mobile and be in control of your own destiny, especially for those looking at renting month to month.

For overall respondents considering renting forever, 33 percent shared that the ability to live in desirable locations was most important. With this in mind, people should consider looking at hot cities for renters when searching for a new location to call home. Some of the components to think about for a location include:

- Proximity to family and friends

- Close to reliable transportation

- Proximity to work

- Walkability

- The type of neighborhood (i.e., downtown, suburban, age-restricted, etc.)

Amenities allow renters access to desirable perks inside their home and building. These can include practical features like in-unit air conditioning, security, online payment options, in-unit washer and dryer, and high-speed internet. They can also introduce luxury and community through on-site fitness centers, pools, balconies or patios, resident events, ample storage, and more.

Our survey found that the other factors of importance to entice renters to rent forever are:

- Financial flexibility and investment opportunities (27%)

- Freedom from homeownership responsibilities (25%)

- Access to community and amenities (15%)

For those seeking a long-term living situation, an apartment building that fosters a sense of community offers more than just a physical space. It provides a social ecosystem that contributes significantly to their overall happiness, well-being, and the feeling of truly being “at home.” In addition, this sense helps renters connect to their neighbors, allowing for a heightened sense of security and looking out for one another.

Interestingly, the order of important factors changes when looking at millennial and Gen Z renters. People aged 18-44 share that the most important factor to consider when renting forever is financial flexibility and investment opportunities (32 percent). This is followed by:

- The ability to live in desirable locations (29%)

- Freedom from homeownership responsibilities (23%)

- Access to community and amenities (17%)

This difference shows that these generations are more likely to be driven by finances than older generations, who are more driven by living in a favorable location.

Find Your Ideal Rental Location and Property with Apartments.com

The rent forever phenomenon offers renters less stress and more freedom regardless of their age demographic. Whether you’re searching for affordability based on your budget or a popular location, Apartments.com can help you explore options to meet your requirements.

If you’re unsure where to start searching for an apartment, use our cost of living calculator to help you compare cities throughout the U.S. to see how far your earnings can go. Then you can narrow down your list of cities based on your preferences and finances.

Methodology

The survey of 523 adults ages 18 and over was conducted via SurveyMonkey Audience for Apartments.com on April 10, 2025. Data is unweighted and the margin of error is approximately +/-4% for the overall sample with a 95% confidence level.

Rent Forever FAQs

Find answers to related questions about the rent forever phenomenon below:

Can you live in an apartment forever?

Yes, you can choose to live in the same apartment throughout your entire lifetime. However, whether or not you actually do is influenced by a variety of factors, including:

- Affordability

- Lease terms

- Relationship with your landlord

- Expanded needs as you age

Is it bad to rent forever?

No! While the traditional American dream has long focused on homeownership, our survey indicates people view owning a home as a financial burden. Renting offers people:

- More stability amid a volatile housing market

- The ability to save money instead of spending it on costly repairs

- More flexibility to relocate to meet your housing needs

What’s the difference between rent forever and rent-to-own?

Rent forever is a long-term choice to rent over homeownership. Rent-to-own is a contractual agreement in which the renter pays monthly and either is obligated or has the option to purchase their rental at the end of a specified period.

In short, the goal of rent forever is to not own property for more flexibility, whereas the goal of rent-to-own is to ultimately own the property with time provided to save.