Key Takeaways

- 70% of new units across the U.S. added to the rental market over the last 12 months are concentrated in major metro areas.

- Rent decreases are concentrated in Sun Belt and West Coast states, with three cities on Florida’s Gulf Coast leading the declines.

- Cities with the biggest rent drops are experiencing oversupply from new construction, putting pressure on property managers to price rentals more competitively and offer rent concessions.

Why Are Rents Dropping?

"New deliveries have pushed vacancy rates well above the national average, forcing property managers to compete more aggressively on price."

Grant Montgomery, National Director of U.S. Multifamily Analytics, CoStar Group

Rent prices typically decline due to oversupply, decreasing population, or the seasonality of moves. Oversupply creates a renter’s market, where renters hold the negotiating power due to the imbalance of supply and demand. When demand for rentals eases and vacancy rates rise, property managers must lower their prices or offer rent concessions to compete with other rentals in the area.

In 2025, construction is the primary driver behind falling rent in the hardest-hit cities. Grant Montgomery, the National Director of U.S. Multifamily Analytics for CoStar Group, says, "Rapid construction in major metro areas has fundamentally shifted the balance of supply and demand, leading to notable rent declines in several Sun Belt and West Coast cities."

According to CoStar Group’s United States Multi-Family Market Report, about 560,000 new units have been added to the rental market over the last 12 months. 70% of these new units are concentrated in major metro areas in anticipation of higher demand due to the increasing popularity of renting.

Montgomery says this surge in construction is causing turbulence: "New deliveries have pushed vacancy rates well above the national average, forcing property managers to compete more aggressively on price."

Moreover, rents aren’t just dropping in these cities—they’re becoming more affordable relative to renters’ incomes. According to CoStar Group’s U.S. Multi-Family Market Report, the median household income in the U.S. increased by 2.8% over the last year, giving renters more purchasing power by outpacing the national average rent increase of 0.6%. In markets where rents are on the decline while incomes are increasing, renters can get even more for less.

Where Are Rents Dropping?

Sun Belt and West Coast states are leading rent declines; Colorado, Arizona, and Texas experienced the largest state-level decreases, while Florida’s Gulf Coast cities are at the forefront of city-level drops due to rapid construction. All of Florida is seeing a massive surge in construction, but deliveries are especially high along the Gulf of Mexico as cities recover from Hurricanes Helene and Milton in 2024.

Here are 10 cities that have seen notable rent declines in rent over the past year.

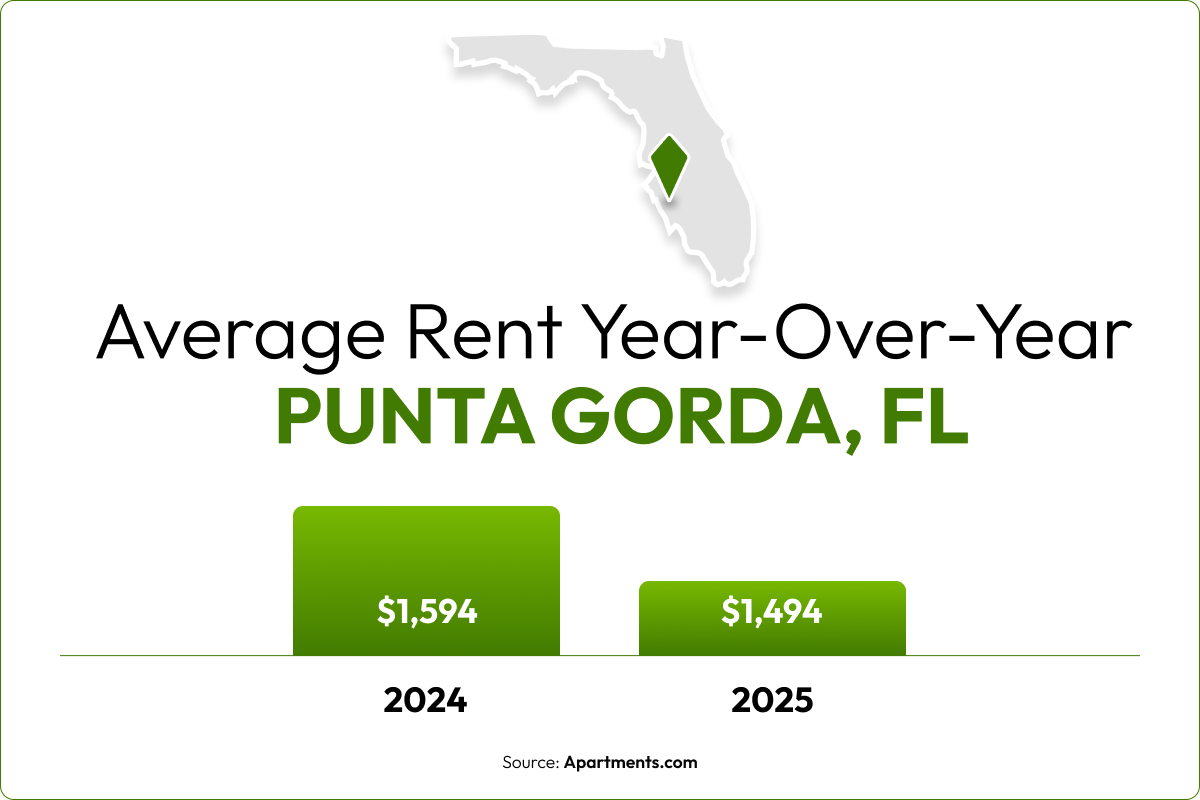

Punta Gorda, FL

Current average rent: $1,494/month

Year-over-year decrease in average rent: -6.3%

Year-over-year increase in median household income: +2.3%

In Punta Gorda, a surge in new rentals near the end of 2023 caused a spike in vacancy rates and a sharp decrease in rent. While vacancies have since dropped, competition has kept rents low. The vacancy rate is currently 12.2%, the lowest since early 2023, and the average rent is the lowest since 2019.

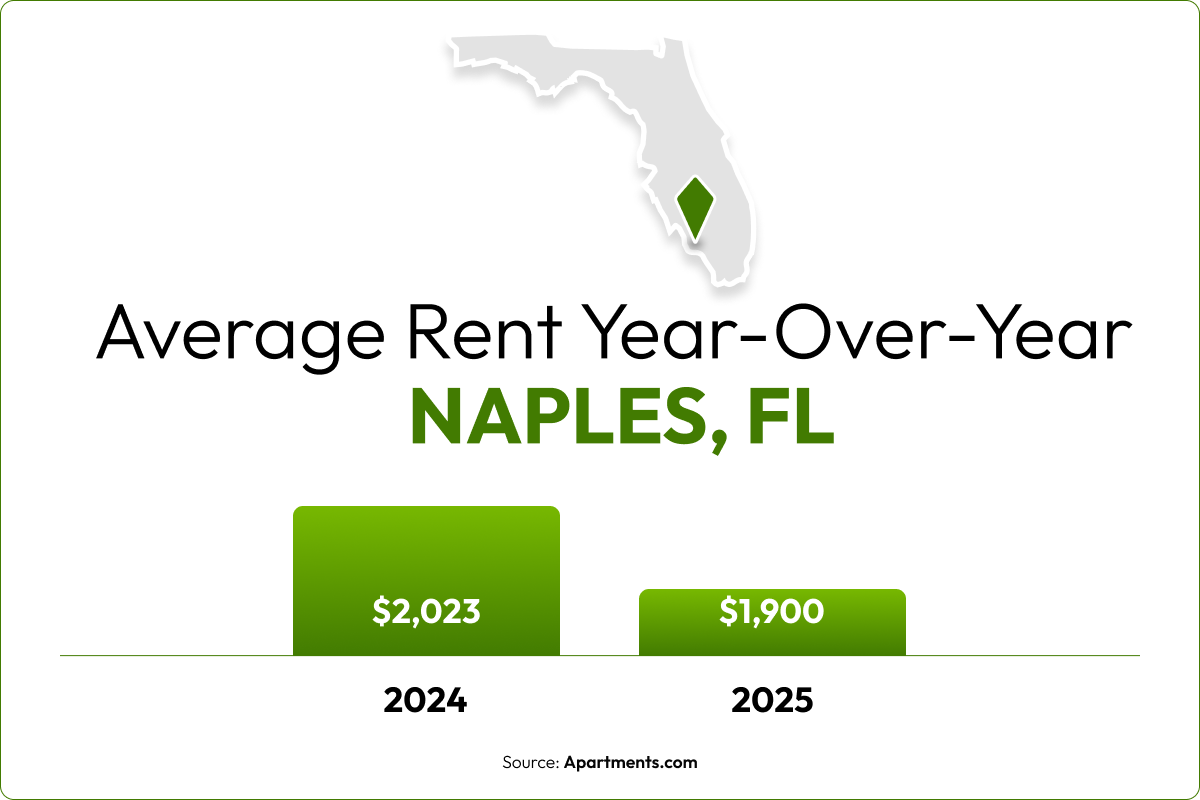

Naples, FL

Current average rent: $1,900/month

Year-over-year decrease in average rent: -6.1%

Year-over-year increase in median household income: +0.3%

This year, Naples has seen the most new units added to the rental market since 2022 and is expected to set a new annual record by the end of 2025. With a relatively stagnant population, Naples’ rental market is favoring renters.

Rent and the overall vacancy rate are projected to remain relatively stable through the end of 2026. Unless the city’s strong construction continues through next year, long-term renters should keep an eye out for rising prices.

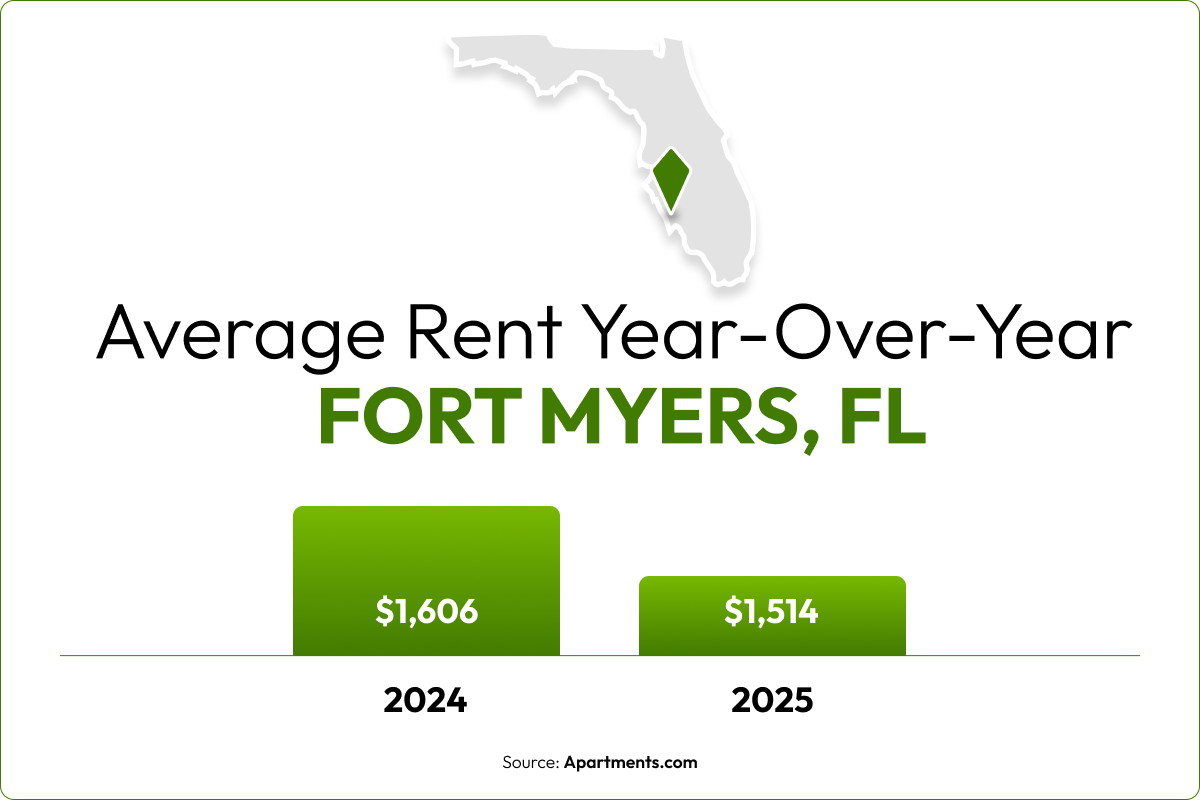

Fort Myers, FL

Current average rent: $1,514/month

Year-over-year decrease in average rent: -5.7%

Year-over-year increase in median household income: +2.6%

Fort Myers experienced a 3.34% population increase in 2024, but new construction pushed the vacancy rate to 17.9%, more than double the national average of 8.2%. While vacancy rates may decline by the end of 2026, rent levels are expected to remain stable, keeping Fort Myers a renter-friendly market.

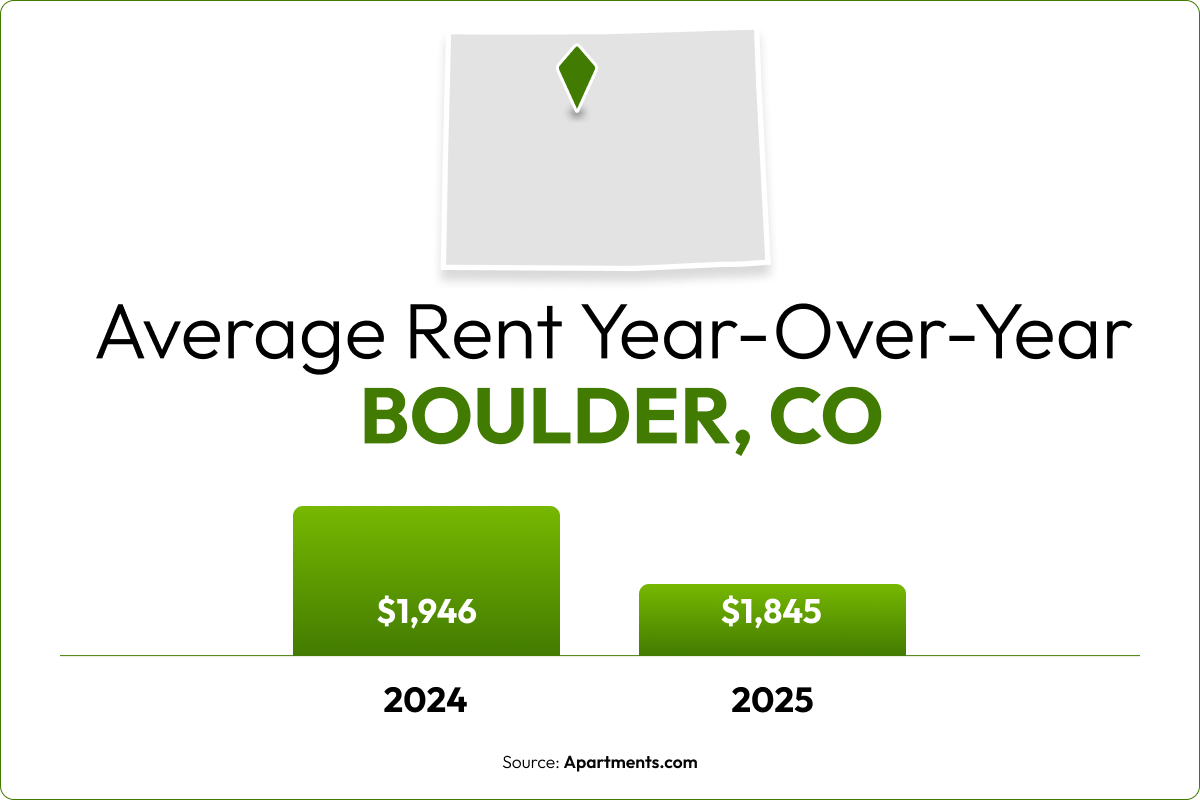

Boulder, CO

Current average rent: $1,845/month

Year-over-year decrease in average rent: -5.2%

Year-over-year increase in median household income: +2.5%

Roughly 800 new units entered Boulder’s market in late 2025, pushing the vacancy rate to 10.7%. With more competition and ongoing population decline, property managers are offering more concessions than in 2024.

CoStar Group projects rent growth picking back up in 2026 and 2027 as more units are leased up and fewer new builds enter the market. This means that rent deals are likely best through early 2026 before moving season begins and vacancies decline.

Sherman, TX

Current average rent: $1,090/month

Year-over-year decrease in average rent: -4.4%

Year-over-year increase in median household income: +4.5%

Sherman is facing a rental surplus after nearly 1,000 new units were added in late 2024. However, rents and vacancy rates are expected to stabilize by the end of 2026, likely as a result of new manufacturing plants for Texas Instruments and GlobiTech, Inc. projected to create over 3,000 new jobs. Until then, expect competitive pricing and leasing incentives.

Asheville, NC

Current average rent: $1,465/month

Year-over-year decrease in average rent: -4.2%

Year-over-year increase in median household income: +3.9%

Asheville’s market is still rebounding from Hurricane Helene in September 2024. High vacancy rates—projected to stay above 14% through 2026—are paired with increased new unit deliveries and lower demand, resulting in a 4.2% decrease in Asheville’s average rent.

Phoenix, AZ

Current average rent: $1,294/month

Year-over-year decrease in average rent: -3.8%

Year-over-year increase in median household income: +2.9%

According to CoStar Group’s Phoenix Multifamily Market Report, over 40,000 units entered Phoenix’s market in 2024 while the population grew by just 12,500. The vacancy rate rose from 10.7% to 12.4%. Rent drops may slow by late 2026 as fewer units are added and vacancies decline.

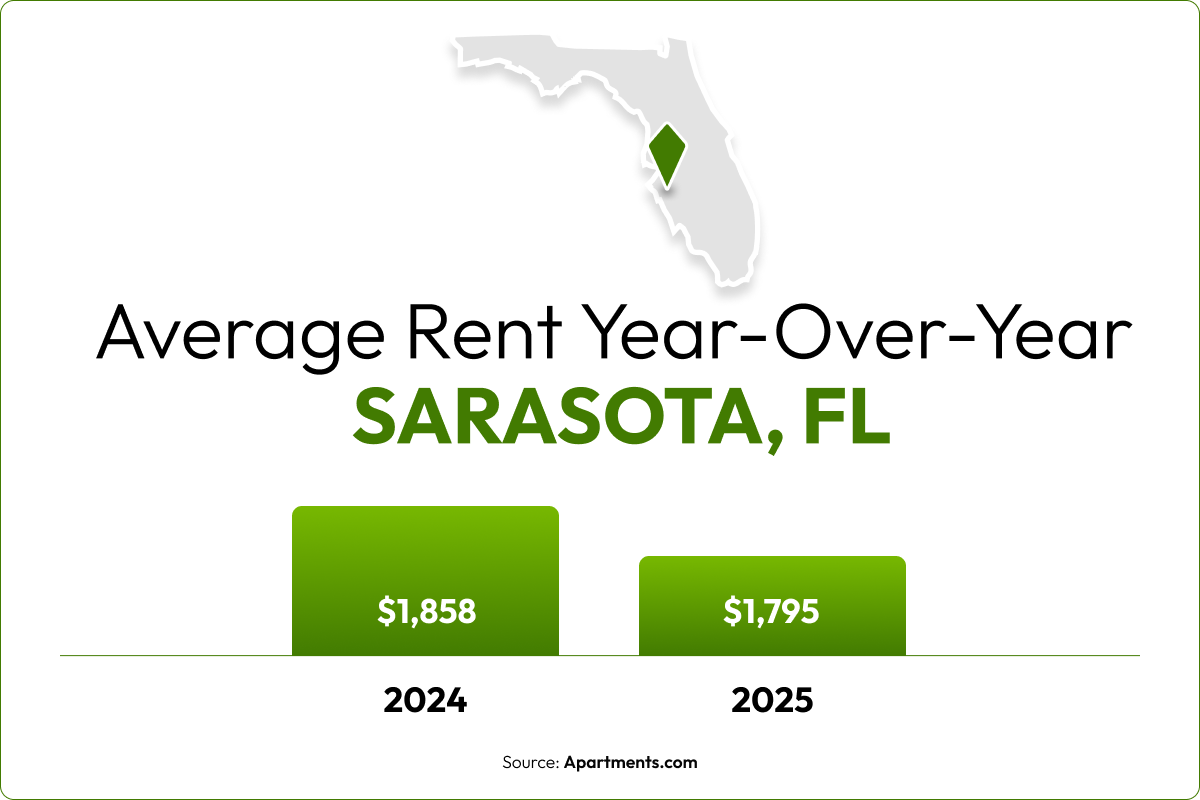

Sarasota, FL

Current average rent: $1,795/month

Year-over-year decrease in average rent: -3.4%

Year-over-year increase in median household income: +3.7%

Like in many other Florida cities, rapid construction in Sarasota over the last few years is outpacing demand and pushing rents downward.

Construction of new units is expected to remain strong throughout 2026, despite a dropoff during moving season. While CoStar Group’s forecasts show the vacancy rate fluctuating—rising to 17.1% and then dropping to 15.7%—rents are expected to hold steady.

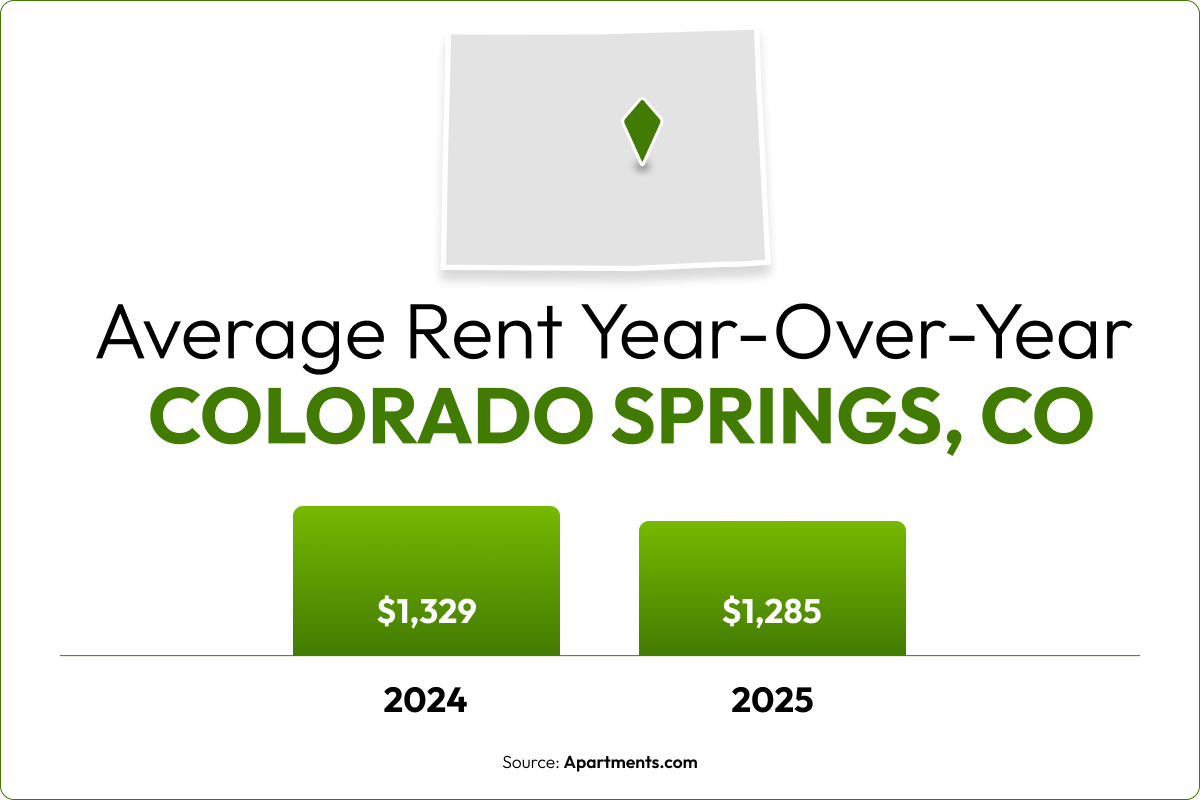

Colorado Springs, CO

Current average rent: $1,285/month

Year-over-year decrease in average rent: -3.3%

Year-over-year increase in median household income: +3.9%

Despite five years of population growth and strong lease-ups, Colorado Springs’ rental market is oversupplied. Rents are down due to this surplus, but CoStar Group forecasts stabilization in 2026 as new construction slows.

Austin, TX

Current average rent: $1,400/month

Year-over-year decrease in average rent: -3.1%

Year-over-year increase in median household income: +3.6%

Over 20,000 new units have entered Austin’s market since early 2024, pushing the vacancy rate to 14.7%. It’s not expected to dip below 13% until late 2026. Construction is beginning to slow, suggesting that renters will find the best deals before the summer 2026 moving season.

What Renters Should Know for 2026

"The next few quarters will be critical for tracking how quickly these markets rebalance."

Grant Montgomery, National Director of U.S. Multifamily Analytics, CoStar Group

The construction surge in 2024 and 2025 is expected to slow in 2026, with vacancy rates stabilizing. However, demand for rentals continues to grow as more people choose renting over homebuying. This could make 2026 the calm before the storm.

Montgomery says the beginning of 2026 will determine the trajectory of the hardest-hit markets: "We expect stabilization as construction slows and excess inventory is absorbed. The next few quarters will be critical for tracking how quickly these markets rebalance."

The long-term direction of these renter's markets depends on whether construction regains momentum in late 2026 and early 2027, but renters can expect low prices in oversupplied cities for the next several months.

Additionally, suburban areas are seeing rising rents due to unprepared rental markets, particularly in the Midwest where AI data centers are drawing new residents. Smaller cities may experience rent increases as demand outpaces supply.

Markets to watch

Some cities are seeing more subtle shifts. Keep an eye on these rental markets in 2026.

Salt Lake City, UT

Projected year-over-year rent decrease: -2.6%

Projected year-over-year income increase: +3.0%

Over 4,000 new units have hit Salt Lake City’s market in 2025 so far, and 2,000 more are expected to enter the market by the end of 2026. The vacancy rate is already high at the current 10.8%, and new deliveries will only put more downward pressure on prices.

Las Vegas, NV

Projected year-over-year rent decrease: -2.5%

Projected year-over-year income increase: +1.1%

The average rent in Las Vegas has been seeing a gradual decline since 2022, but 2026 is expected to solidify it as a renter's market. A steady stream of new builds will keep the vacancy rate at about 10% throughout 2026 while requiring property managers to lower prices.

Orlando, FL

Projected year-over-year rent decrease: -2.4%

Projected year-over-year income increase: +1.5%

Despite steady population growth and demand for luxury units, rent is already falling in Orlando. Rapid supply growth has offset the demand for rentals, and fewer lease-ups in 2026 compared to those in the past few years will keep the vacancy rate high.

Tampa, FL

Projected year-over-year rent decrease: -2.3%

Projected year-over-year income increase: +2.3%

Rental demand in Tampa slowed in 2025 from the historic highs in 2024 as residents displaced by Hurricanes Helene and Milton in 2024 returned home. This low demand is expected to continue through 2026, made even lower by new builds entering the market.

Raleigh, NC

Projected year-over-year rent decrease: -1.6%

Projected year-over-year income increase: +1.9%

With multiple colleges in the area and a thriving tech industry, demand for rentals has been high in Raleigh. However, high vacancy rates—especially in luxury units—are driving rents down.

Keep Up with the Market on Apartments.com

Thinking about relocating? Apartments.com makes planning easy. Use our Cost of Living Calculator to compare cities, explore Rent Trends for market insights, and read our monthly rent report for the latest news in the rental industry.

When you’re ready to move, Apartments.com helps you find your next place with customizable filters and neighborhood guides. Explore your options, stay informed, and rent smarter on Apartments.com.

Household income and apartment rent data provided by CoStar Group’s October 2025 market reports.