Key Takeaways

- Renters should budget for one-time and monthly fees when building a budget for an apartment.

- One-time fees are usually 33% to 50% of the monthly rent price.

- On average, monthly fees add $65 to a renter’s monthly payments.

- Some states have passed laws requiring landlords to advertise the total monthly cost of a rental in their listing.

- Apartments.com’s price transparency structure, unit-level shopping experience, and Cost Calculator give renters a clear idea of what they’ll pay.

When you rent an apartment, the base rent is just one piece of the puzzle. From move-in fees to monthly add-ons, the true cost of renting can catch new renters off guard. Understanding all the upfront and recurring costs can help you budget confidently and avoid surprises down the line.

What Will I Actually Pay?

Here are some costs you should consider when budgeting for an apartment:

Security deposit

A security deposit is a financial safety net for property managers in case a tenant fails to pay rent or damages the rental. Property managers use a tenant’s security deposit to cover unpaid rent or the cost of repairs.

The amount you’ll pay for your security deposit varies depending on your rental and credit history, but tenants are typically charged one- to two months’ rent. While you’ll be refunded your security deposit if you leave your rental in good condition when you move out, you’ll need to budget for the cost when you move in.

Move-in fees

Move-in fees are one-time costs that you’ll pay when you move in. Here are some common move-in charges you should be aware of.

Application fee

The application fee is the first fee that you’ll pay on the day you apply to rent a property. An application fee typically ranges from $25 to $100 per applicant depending on the location and type of rental you are applying for and is used to cover the cost of tenant screening. Application fees are usually non-refundable.

Administration fee

An administration fee is a fee property managers charge during the application process to cover the behind-the-scenes work of setting up a lease and preparing a rental for move-in. Administration fees can range from $50 to $500, depending on the rental’s location and management type. These fees are typically non-refundable.

First or last month’s rent

Depending on the apartment, you may have to either pay first month’s rent, first and last month’s rent, or prorated rent on move-in day. How much you’ll pay on move-in day typically depends on the apartment management’s policies, along with your background and credit check.

Pet fee or deposit

If you’re living with a furry friend, you might have to pay a pet fee or pet deposit, too.

Pet fees and deposits are both one-time charges you’ll pay before you move in, but they differ in a few ways. Pet fees are non-refundable fees that property managers may charge to cover the cost of cleaning a pet-friendly rental. However, pet deposits may be refunded if your pet doesn’t damage the rental, just like how security deposits are refundable if you leave your rental in good condition. Pet fees and pet deposits are both usually around $200 to $500.

Utility start-up fee

If you’re responsible for setting up your own utilities, you may have to pay internet, water, gas, or electricity connection fees for a new service. These fees are typically around $50 to $100 per service, depending on where you live.

Excluding first and last month’s rent, move-in fees are generally 33% to 50% of the monthly rent price. For the national average rent of $1,639/month, move-in fees could be somewhere between $546 to $820.

Utilities

Utilities may be included as a fixed monthly fee or bundled into the total rent price.

However, some rentals require tenants to set up and pay utilities independently. If this is the case, your water, electricity, and gas bills will depend on your usage.

Monthly fees

Many apartment communities charge nonoptional monthly fees for pest control, valet trash, and community amenities.

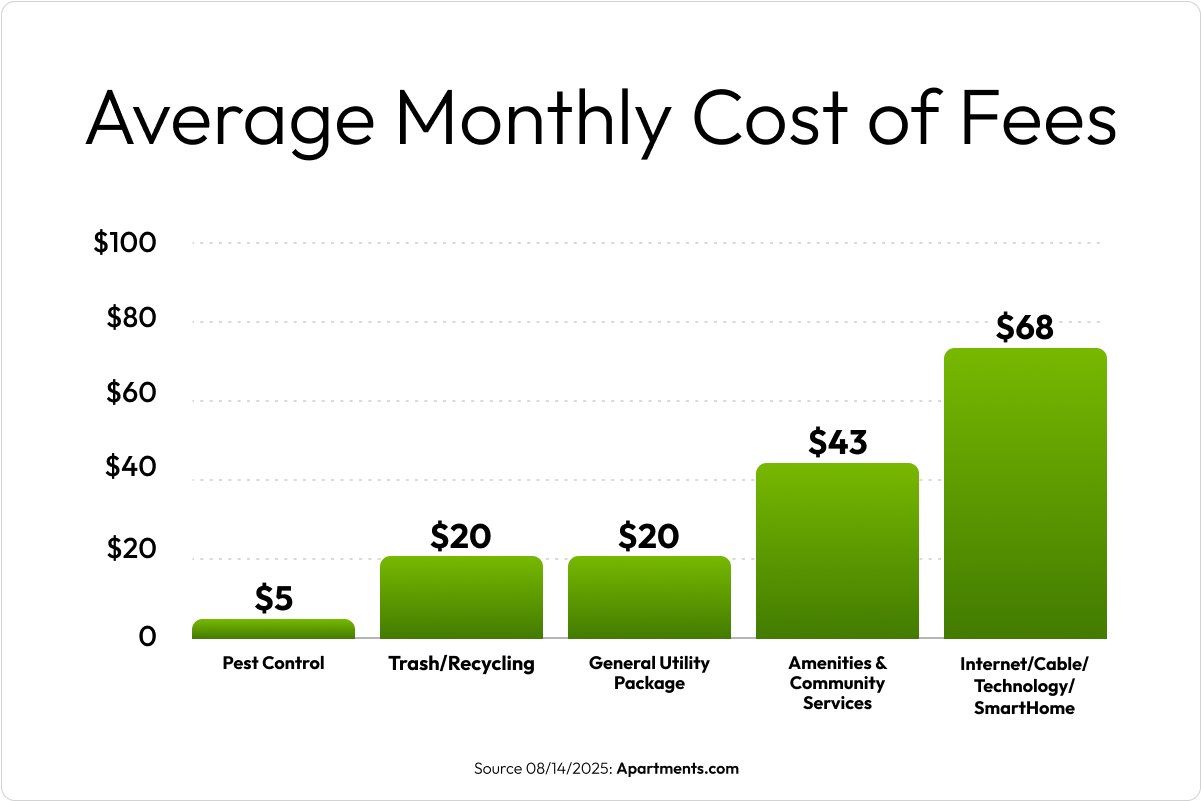

According to Apartments.com data, the most common fees apartment communities charge are for trash, pest control, amenities and community services, internet, and utility packages. On average, nonoptional fees add $65 to monthly payments.

In addition to the required fees, renters may pay additional fees for pets or reserved parking. Pet rent is typically $10 to $50 each month per pet. Reserved or covered parking can range from $50 to $300 depending on where you live; apartment communities in big cities and city centers typically charge more for parking than those in suburban areas.

Renters insurance

Renters insurance is a financial safety net that protects you and your belongings in case of emergencies like theft or fire damage. A standard renters insurance policy typically covers personal property, liability, and additional living expenses.

According to ValuePenguin research, renters insurance averages about $23 per month across the U.S. The price you pay for renters insurance varies depending on where you live and how much coverage you buy, but it’s a small cost compared to the protection it guarantees.

What to Know About Fee Transparency Laws

Price transparency has been a hot topic in the rental industry since the FTC’s Rule on Unfair or Deceptive Fees passed. While the regulation initially applied to ticketed events and short-term lodging, an FTC lawsuit extended the legislation to residential rental listings.

State laws

So far, six states have passed laws requiring landlords to advertise the total cost of their rental in a listing: Colorado, Connecticut, Massachusetts, Minnesota, Nevada, and Virginia.

Know the Full Price on Apartments.com

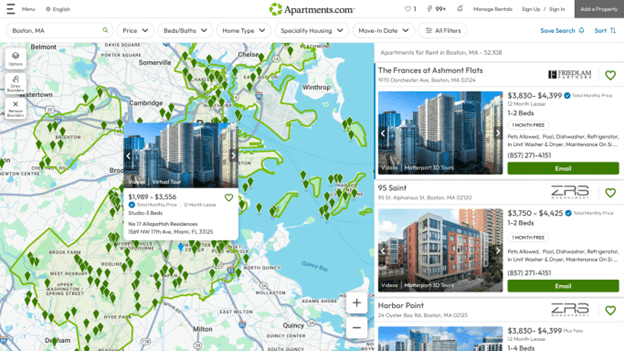

Apartments.com has implemented an all-in pricing structure that allows property managers to specify whether their listed rent price includes all monthly required fees. Properties that have the total cost advertised on their listing will have a “Total Monthly Price” badge, taking the guesswork out of your rental search.

In compliance with state laws, listings in states where price transparency laws are in effect will have a “Total Monthly Price” badge, or they’ll have “Plus Fees” written below pricing information on the search results page.

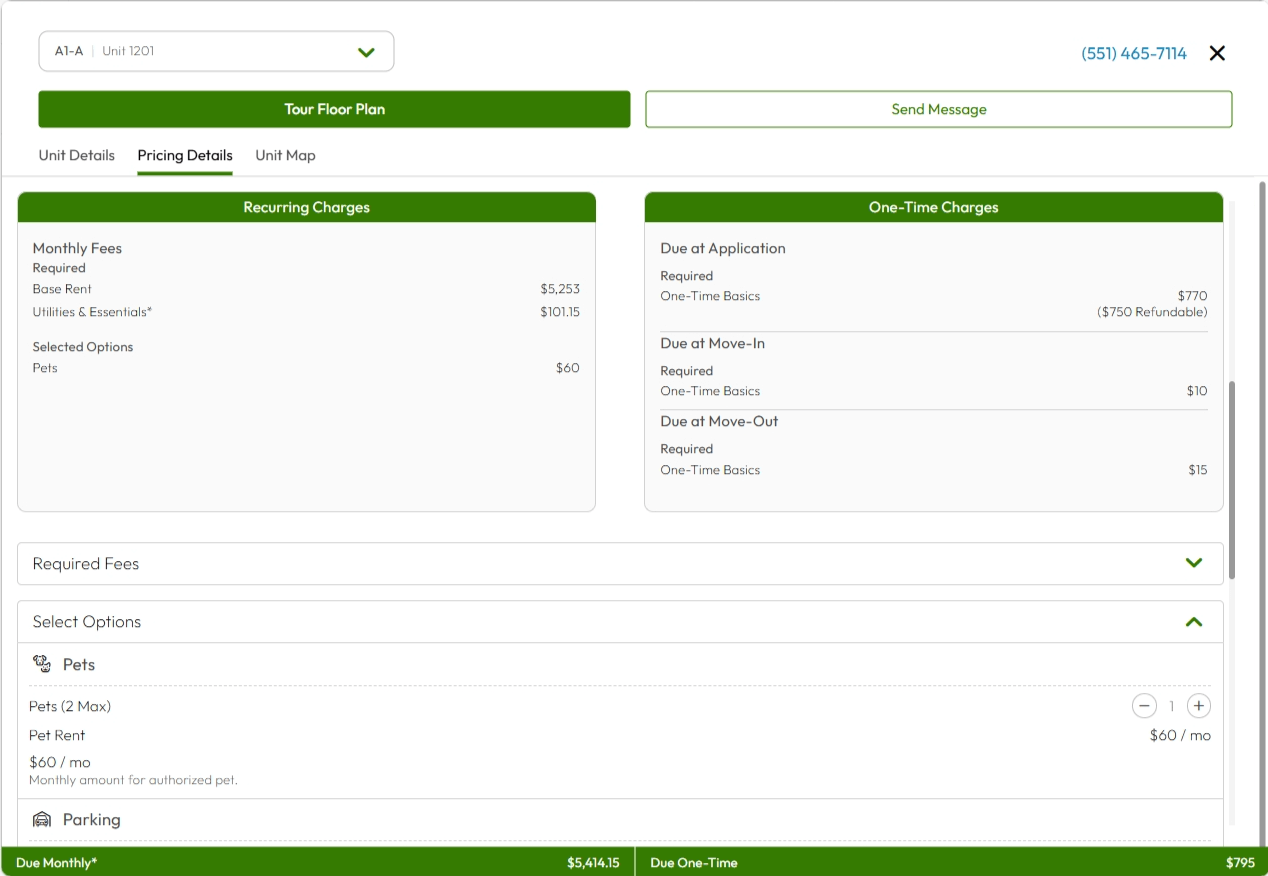

In addition to the fee transparency structure, Apartments.com’s Cost Calculator and unit-level shopping experience help renters across the country get a clear idea of what they’ll pay each month.

Unit-level shopping allows you to view the base rent, unit details, photos, and Matterport 3D tours for specific units in an apartment community. The Cost Calculator adds the base rent, required fees, and optional add-ons like pets or covered parking to estimate your one-time and monthly payments for a specific unit in an apartment community. Both of these features work together to give you the most transparent apartment searching experience possible.

Renting an apartment involves more than just paying rent. Between security deposits, utilities, and pet fees, your total cost can add up quickly. Fortunately, tools like Apartments.com’s Cost Calculator and unit-level shopping experience make it easier than ever to understand exactly what you’ll pay before you even tour. By knowing what to expect, you can create a budget, compare options, and find a place that fits both your lifestyle and your wallet.

Originally published on May 19, 2023, by Megan Bullock, and has been updated.